The place’s My Refund? A 2025 Tax Refund Calendar and Information to Understanding Delays

Associated Articles: The place’s My Refund? A 2025 Tax Refund Calendar and Information to Understanding Delays

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to The place’s My Refund? A 2025 Tax Refund Calendar and Information to Understanding Delays. Let’s weave attention-grabbing data and supply recent views to the readers.

Desk of Content material

The place’s My Refund? A 2025 Tax Refund Calendar and Information to Understanding Delays

Tax season is a whirlwind of paperwork, calculations, and the hopeful anticipation of a refund. For a lot of, that refund represents an important monetary lifeline, used for debt reimbursement, dwelling enhancements, or just a much-needed increase to financial savings. However what occurs when your refund does not arrive on time? Understanding the 2025 tax refund timeline and the potential causes for delays is vital to managing expectations and addressing any points proactively.

This text serves as a complete information to navigating the 2025 tax refund course of, providing a projected calendar, outlining widespread causes for delays, and offering actionable steps to take in case your refund is late. Whereas particular dates are topic to alter primarily based on IRS bulletins, this calendar gives an affordable estimation primarily based on historic tendencies.

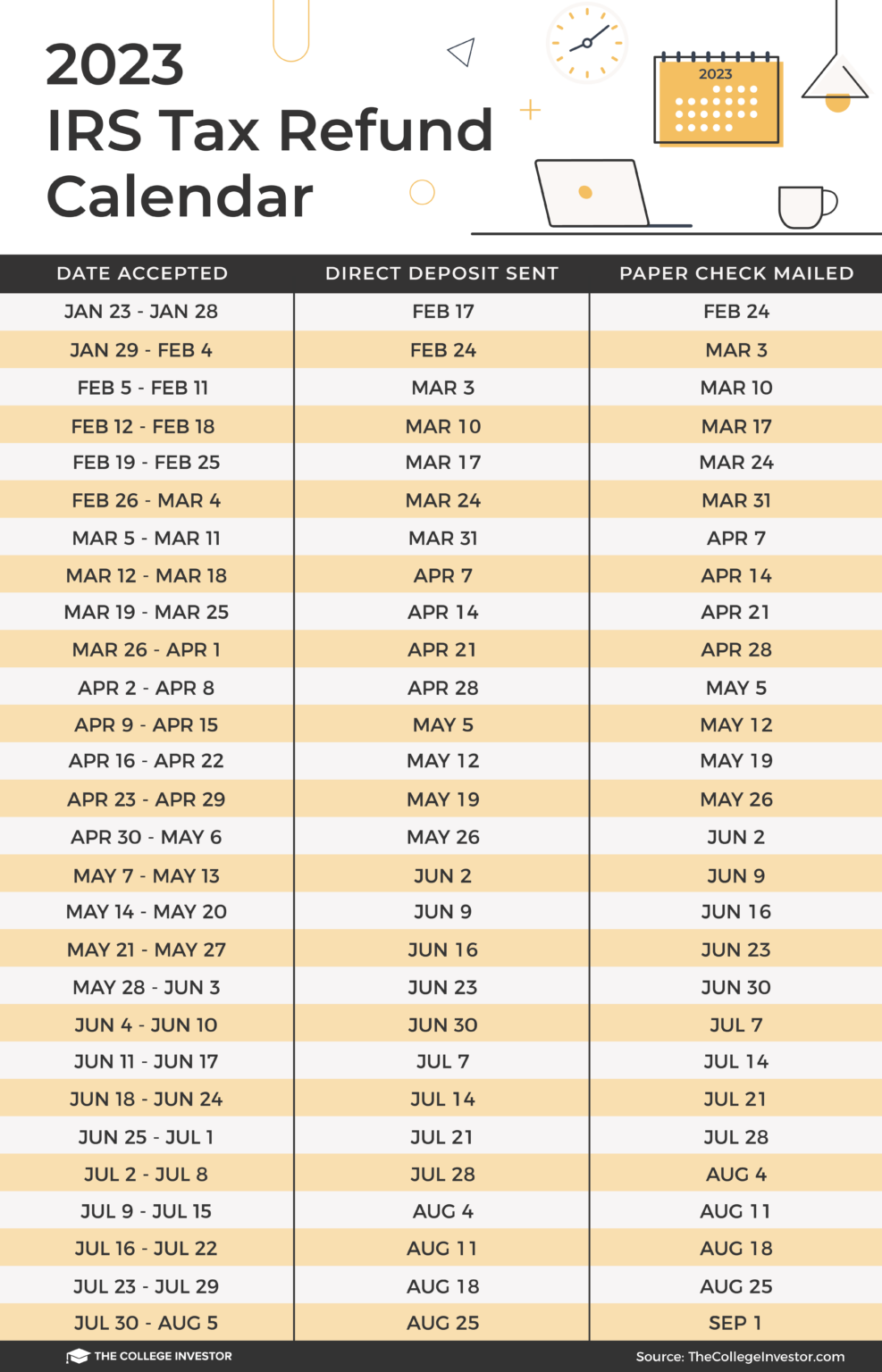

Projected 2025 Tax Refund Calendar (Topic to Change):

Please observe: This calendar is an estimate primarily based on previous IRS processing occasions. The precise dates could fluctuate relying on a number of elements, together with the amount of returns, IRS processing capability, and any unexpected circumstances. At all times discuss with official IRS bulletins for essentially the most up-to-date data.

- January 2025: Tax season formally begins. The IRS begins accepting and processing tax returns. Early filers who e-file and select direct deposit can anticipate the quickest refunds.

- Late January – Early February 2025: Peak submitting season begins. Anticipate longer processing occasions because of the excessive quantity of returns.

- February – March 2025: The vast majority of refunds are issued throughout this era. Nonetheless, delays are extra doubtless because of the excessive quantity of returns.

- March – April 2025: The IRS continues processing returns, with a gradual lower in quantity. Delays are nonetheless doable, however much less frequent than within the peak season.

- April fifteenth, 2025: Tax Day. That is the deadline for submitting your tax return. Extensions could also be granted beneath particular circumstances.

- April – Might 2025: The IRS continues processing returns, addressing any remaining backlogs. Refunds should still be issued, however processing occasions could also be longer.

- Past Might 2025: Refunds issued after this era are doubtless as a consequence of important delays, requiring additional investigation.

Understanding Potential Delays:

A number of elements can contribute to delays in receiving your tax refund:

- Errors on Your Tax Return: Even a small error, reminiscent of an incorrect social safety quantity, checking account data, or mathematical calculation, can considerably delay processing. The IRS could ship you a discover requesting clarification, additional delaying the refund.

- Identification Theft: Identification theft is a significant concern throughout tax season. If the IRS suspects id theft, your return will likely be flagged for additional investigation, which may take a number of weeks and even months.

- Complicated Tax Conditions: Returns with important deductions, credit, or enterprise revenue usually require extra thorough evaluation, resulting in longer processing occasions.

- IRS Processing Backlog: Throughout peak tax season, the IRS could expertise a backlog of returns, inflicting delays even for precisely filed returns. That is significantly true in periods of excessive tax reform complexity or important finances constraints.

- Inadequate Documentation: Should you declare sure deductions or credit, chances are you’ll want to supply supporting documentation. Failure to supply this documentation will delay processing.

- Mathematical Errors: Easy arithmetic errors can halt processing till corrected. Double-check your calculations earlier than submitting.

- Points with Direct Deposit: Incorrect checking account data or account closure can forestall the direct deposit of your refund.

- Amended Returns: Submitting an amended return (Kind 1040-X) will naturally delay the receipt of your refund because the IRS must course of the amended return earlier than issuing a revised refund.

What to Do If Your Refund is Late:

In case your refund is considerably delayed past the projected timeline, take the next steps:

- Verify the IRS Web site: Use the IRS’s on-line device, "The place’s My Refund?", to trace the standing of your refund. This device gives updates on the processing of your return.

- Evaluate Your Tax Return: Rigorously evaluation your tax return for any errors, inconsistencies, or lacking data.

- Contact the IRS: Should you can’t discover the rationale for the delay, contact the IRS instantly by means of their official channels. Keep away from third-party refund providers claiming to expedite the method, as these are sometimes scams.

- Collect Supporting Documentation: Should you claimed any deductions or credit, collect all supporting documentation to supply to the IRS if requested.

- Be Affected person: Whereas irritating, delays are typically unavoidable. The IRS processes thousands and thousands of returns annually, and occasional delays are to be anticipated. Preserve open communication with the IRS to resolve any points promptly.

- Take into account Tax Professionals: In case you are struggling to grasp the rationale for the delay or navigate the IRS’s processes, contemplate consulting a tax skilled. They’ll present steerage and help in resolving the difficulty.

Stopping Delays in 2025:

Proactive measures can considerably scale back the danger of refund delays:

- File Electronically: E-filing is considerably sooner than mailing a paper return.

- Select Direct Deposit: Direct deposit is the quickest option to obtain your refund.

- Double-Verify Your Info: Rigorously evaluation your tax return for accuracy earlier than submitting it.

- Collect All Vital Paperwork: Have all needed paperwork available earlier than you start submitting.

- File Early: Submitting early, earlier than the height season, may help scale back processing time.

- Use Tax Software program or a Skilled: Tax software program may help you establish and proper errors earlier than submitting. A tax skilled can present professional recommendation and guarantee accuracy.

Receiving your tax refund promptly is a vital a part of profitable tax planning. By understanding the projected timeline, figuring out potential delays, and taking proactive steps, you’ll be able to considerably enhance your possibilities of receiving your refund on time in 2025. Bear in mind to all the time seek the advice of official IRS assets for essentially the most correct and up-to-date data. This text is meant for informational functions solely and doesn’t represent tax recommendation. Seek the advice of a certified tax skilled for customized recommendation.

Closure

Thus, we hope this text has offered helpful insights into The place’s My Refund? A 2025 Tax Refund Calendar and Information to Understanding Delays. We admire your consideration to our article. See you in our subsequent article!