Understanding Your Calendar 12 months Deductible for Well being Insurance coverage

Associated Articles: Understanding Your Calendar 12 months Deductible for Well being Insurance coverage

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Understanding Your Calendar 12 months Deductible for Well being Insurance coverage. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Understanding Your Calendar 12 months Deductible for Well being Insurance coverage

Navigating the complexities of medical health insurance can really feel overwhelming, particularly when confronted with phrases like "calendar yr deductible." This seemingly easy phrase can considerably impression your out-of-pocket healthcare bills. Understanding its which means and implications is essential for making knowledgeable selections about your well being protection and managing your price range. This text will present a complete clarification of calendar yr deductibles, exploring their operate, how they work, and the best way to finest make the most of your medical health insurance plan to reduce your prices.

What’s a Calendar 12 months Deductible?

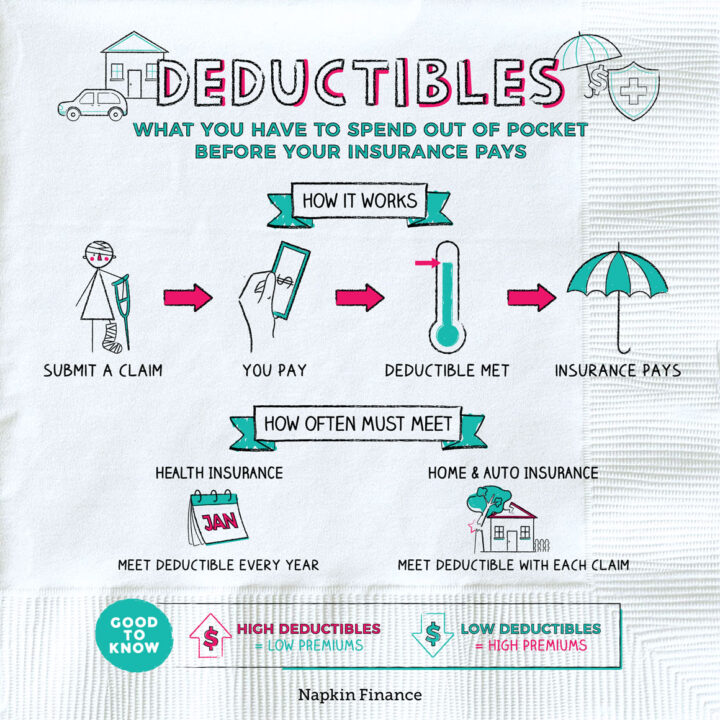

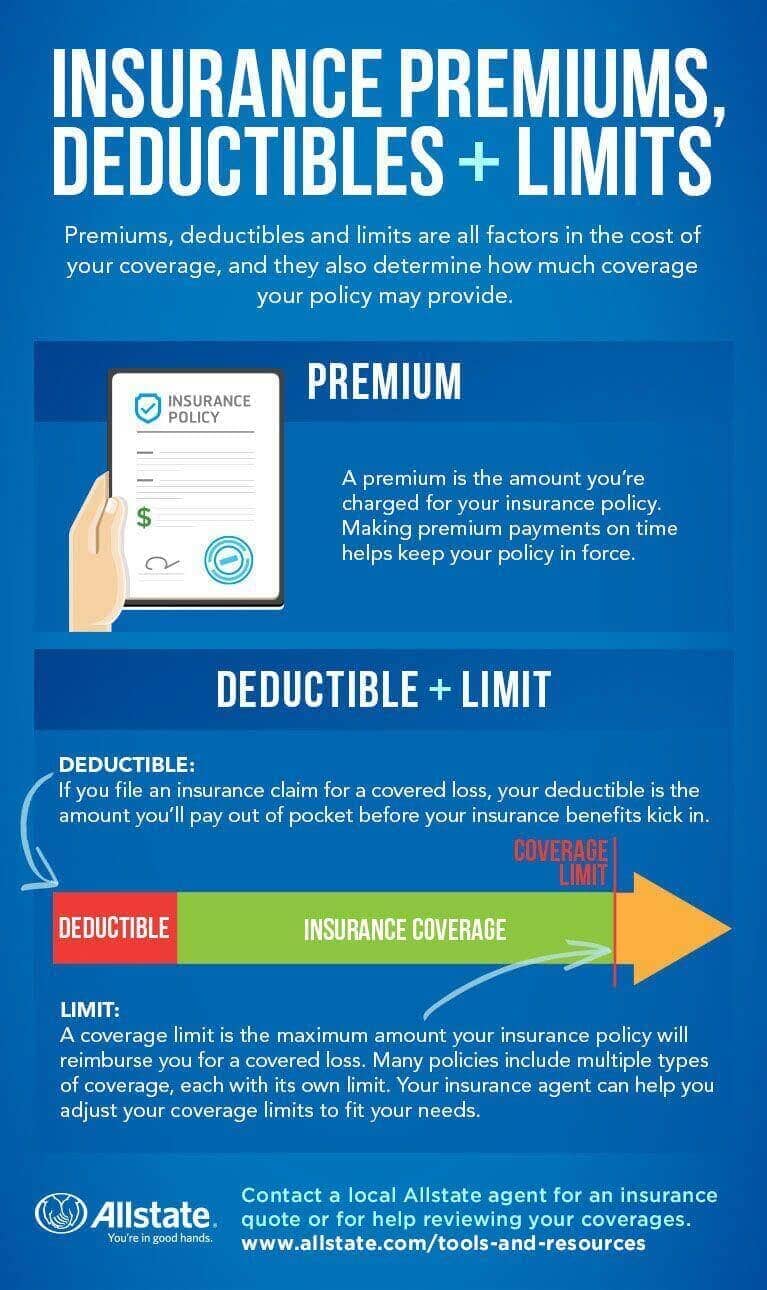

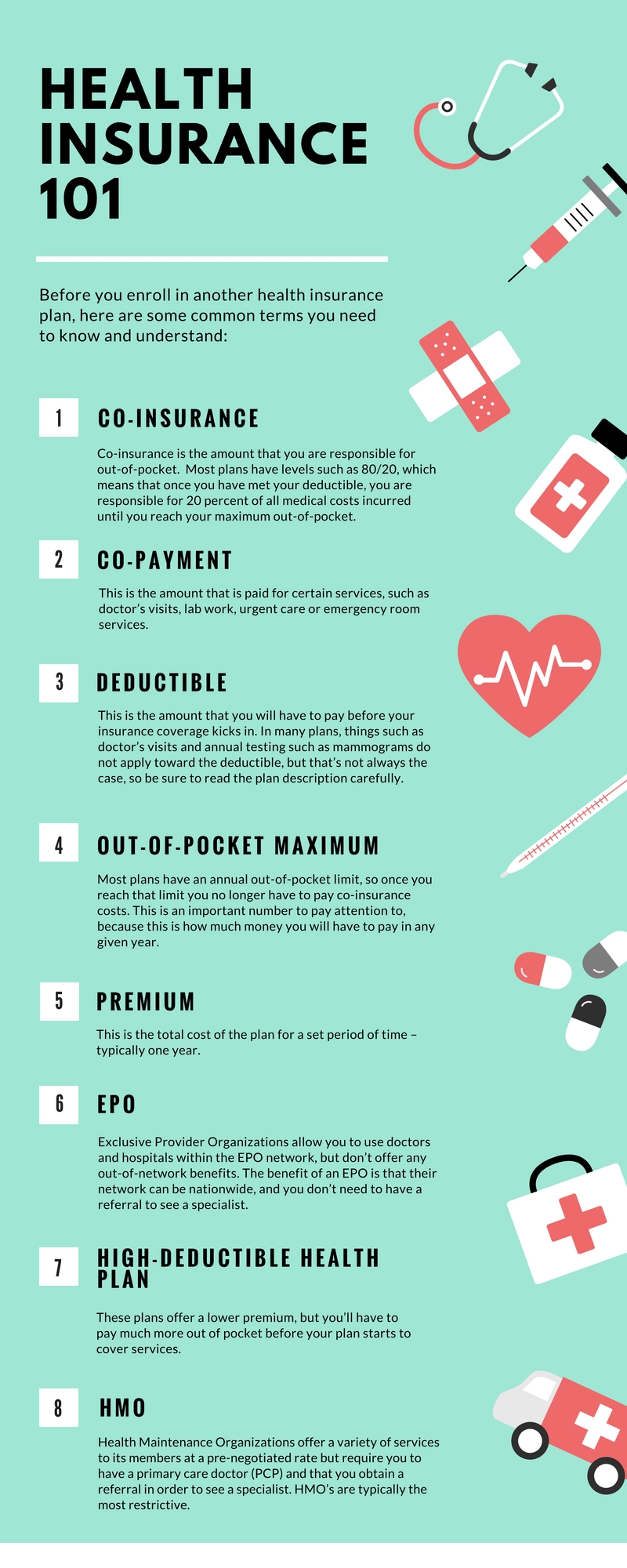

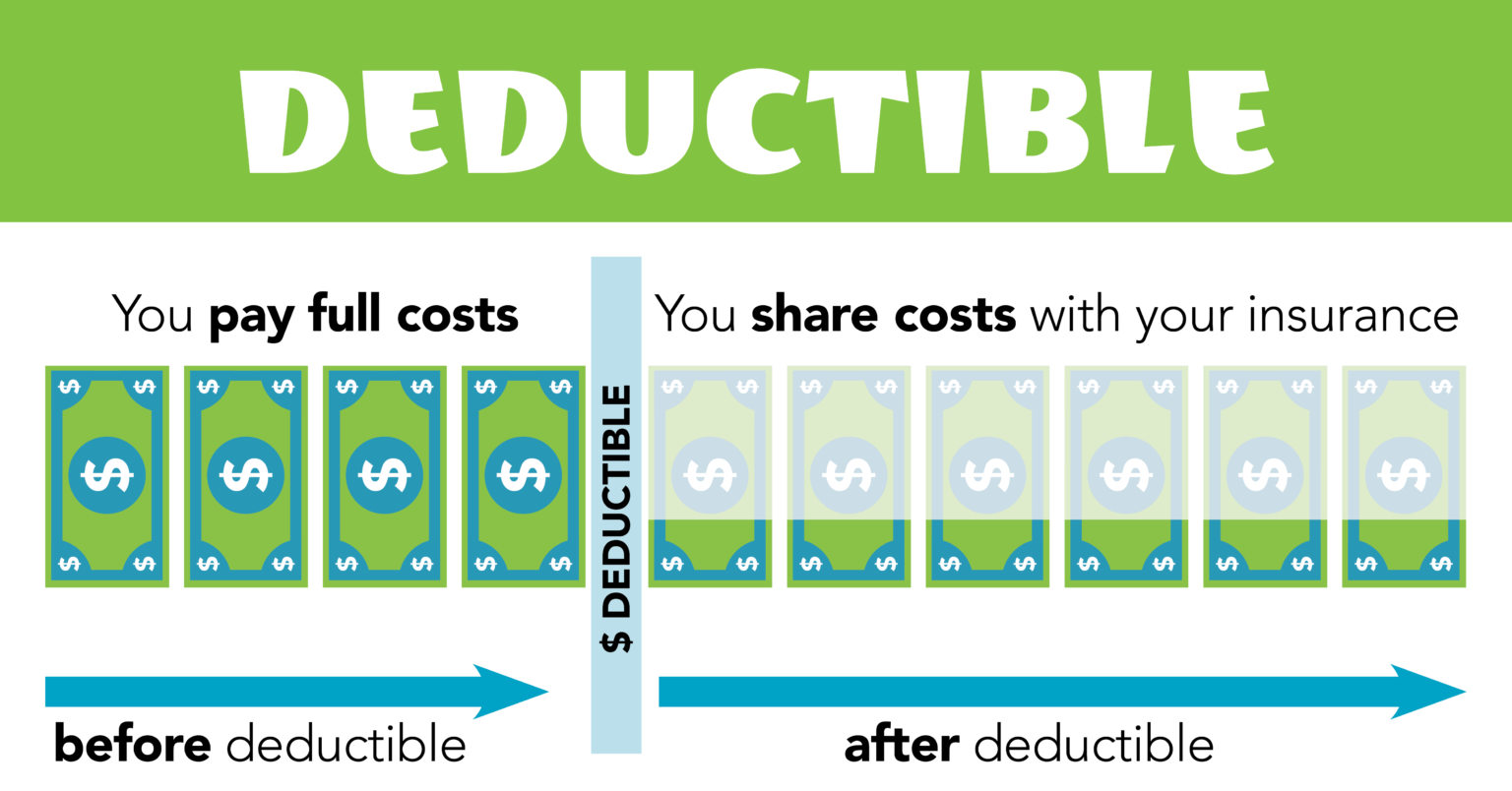

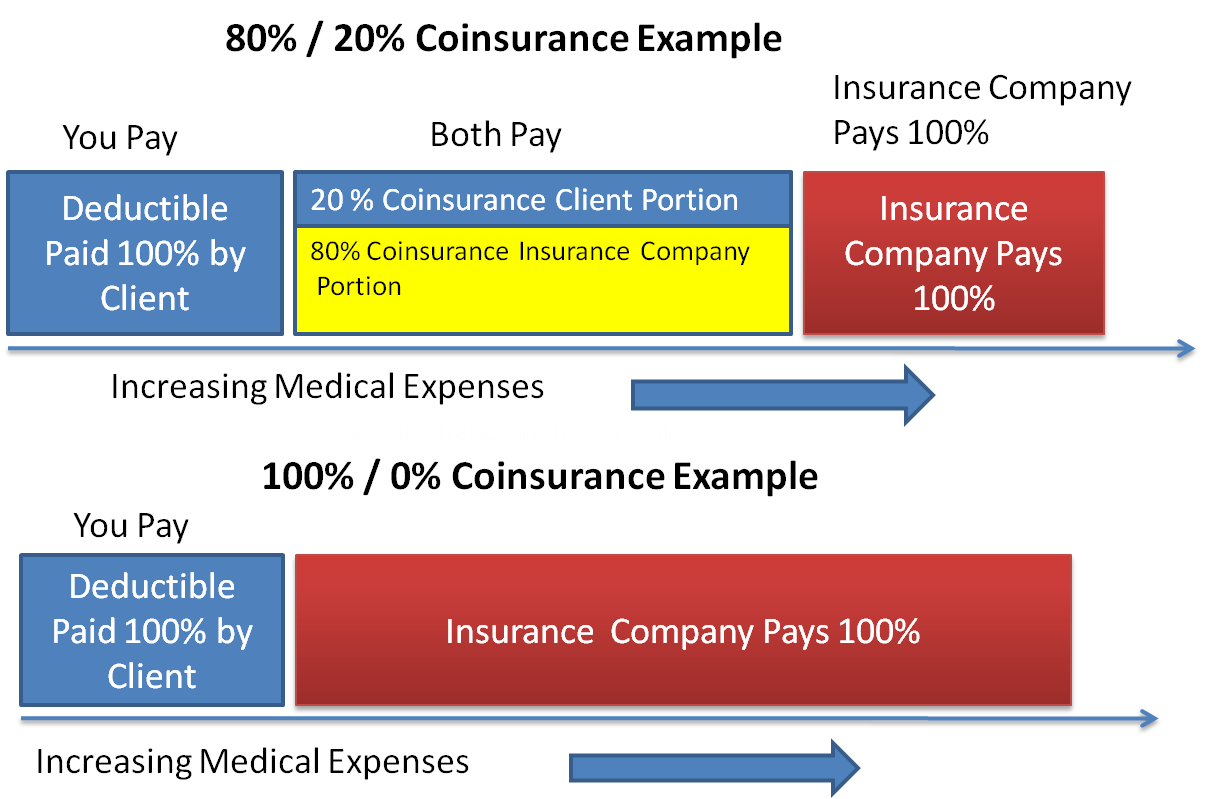

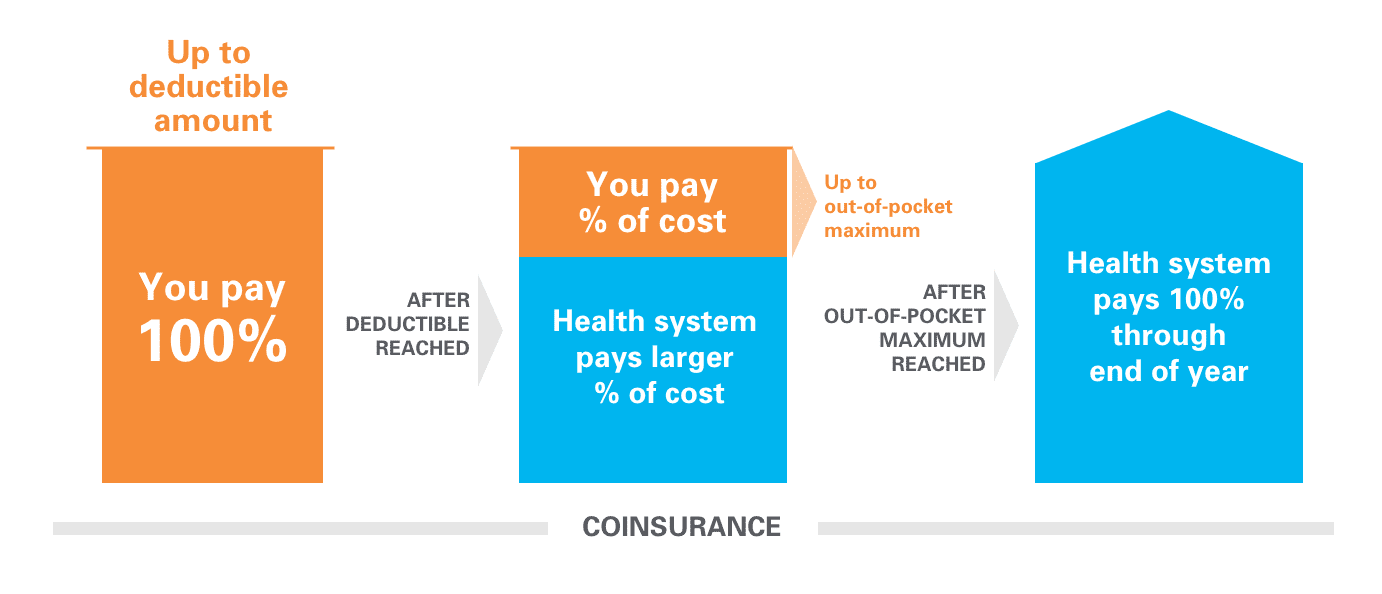

A calendar yr deductible is the amount of cash it’s essential to pay out-of-pocket for lined healthcare companies earlier than your medical health insurance plan begins to pay its share. The important thing right here is "calendar yr," which means the deductible resets on January 1st annually. Not like another deductibles, it is not tied to a particular coverage interval or profit interval. As soon as you’ve got met your deductible, your insurance coverage firm will begin masking a portion of your eligible medical bills, in accordance with your plan’s copay, coinsurance, and out-of-pocket most.

How Does a Calendar 12 months Deductible Work?

Think about your medical health insurance plan has a $5,000 calendar yr deductible. This implies you’re liable for the primary $5,000 in lined medical bills in the course of the calendar yr (January 1st to December thirty first). This contains prices corresponding to physician visits, hospital stays, surgical procedures, pharmaceuticals (relying in your plan’s formulary), and different lined companies. Nonetheless, not all bills depend in direction of your deductible. Many plans exclude companies like beauty procedures or non-essential care.

Let’s illustrate with an instance:

- January: You go to your major care doctor for a routine checkup costing $150. This $150 counts in direction of your $5,000 deductible.

- March: You require emergency room therapy for a sudden sickness, incurring $2,000 in bills. Your remaining deductible is now $5,000 – $150 – $2,000 = $2,850.

- June: You could have a scheduled surgical procedure costing $4,000. Since this quantity exceeds your remaining deductible, you’ll pay the remaining $2,850, and your insurance coverage will cowl the remaining $1,150 ($4,000 – $2,850). Your deductible is now met.

- December: You want a prescription medicine costing $50. As a result of your deductible is met, your insurance coverage will cowl this value in accordance with your plan’s copay or coinsurance.

Totally different Sorts of Deductibles:

Whereas the calendar yr deductible is the most typical, there are different deductible buildings:

- Particular person vs. Household Deductible: Some plans have separate deductibles for people and households. A household deductible requires the household to satisfy a mixed out-of-pocket expense earlier than the insurance coverage firm begins to pay.

- Per-Particular person Deductible: Every particular person lined below the plan has their very own deductible. This implies every particular person should meet their particular person deductible earlier than their insurance coverage kicks in.

It is important to know which kind of deductible your plan makes use of. This data is clearly outlined in your insurance coverage plan’s abstract of advantages and protection (SBC).

Components Affecting Deductible Quantity:

The quantity of your calendar yr deductible is influenced by a number of elements:

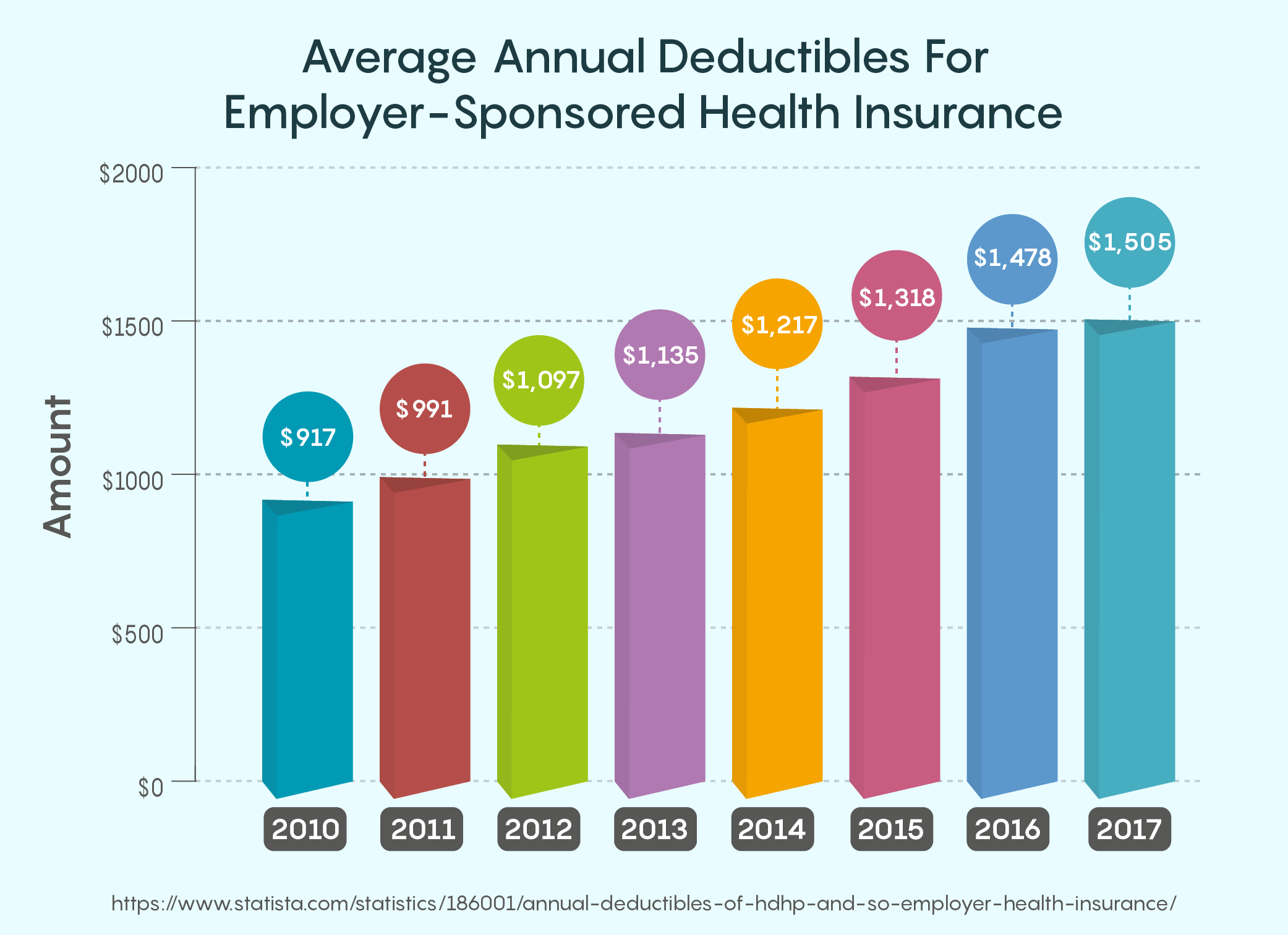

- Plan Sort: Excessive-deductible well being plans (HDHPs) usually have considerably increased deductibles than lower-deductible plans. Nonetheless, HDHPs usually include decrease premiums.

- Insurance coverage Firm: Totally different insurance coverage suppliers provide plans with various deductible quantities.

- Protection Degree: The extent of protection you select (e.g., bronze, silver, gold, platinum) straight impacts your deductible. Bronze plans usually have increased deductibles, whereas platinum plans have decrease deductibles.

Methods for Managing Your Deductible:

Assembly a excessive deductible generally is a important monetary burden. Listed here are some methods to assist handle the prices:

- Well being Financial savings Account (HSA): When you have a high-deductible well being plan (HDHP), you may contribute pre-tax {dollars} to an HSA to pay for certified medical bills. The cash in your HSA rolls over yr to yr, providing a major benefit for long-term financial savings.

- Versatile Spending Account (FSA): An FSA means that you can put aside pre-tax earnings to pay for eligible medical bills. Nonetheless, in contrast to an HSA, unused funds usually expire on the finish of the plan yr.

- Negotiating Medical Payments: Do not hesitate to barter with healthcare suppliers for decrease charges or fee plans.

- Preventive Care: Many plans cowl preventive care companies (like annual checkups and vaccinations) with no cost-sharing, even earlier than you meet your deductible. Benefiting from these companies can assist preserve your well being and keep away from costlier therapies later.

- Understanding Your Plan: Fastidiously evaluate your plan’s abstract of advantages and protection (SBC) to know what’s and is not lined.

The Significance of Understanding Your Out-of-Pocket Most:

Whereas the deductible is a major expense, it is essential to additionally perceive your plan’s out-of-pocket most. That is essentially the most you’ll pay out-of-pocket in a calendar yr for lined companies. When you attain your out-of-pocket most, your insurance coverage firm will cowl 100% of your lined medical bills for the rest of the yr.

Conclusion:

The calendar yr deductible is a vital side of your medical health insurance plan. Understanding the way it works and implementing methods to handle your bills is important for accountable healthcare planning. By fastidiously reviewing your plan’s particulars, using obtainable financial savings choices, and proactively managing your well being, you may navigate the complexities of your deductible and make sure you obtain the healthcare you want with out going through undue monetary pressure. Keep in mind to seek the advice of together with your insurance coverage supplier or a healthcare monetary advisor for customized steerage and to make clear any uncertainties about your particular plan. The knowledge supplied right here is for basic understanding and shouldn’t be thought-about an alternative to skilled monetary or medical recommendation.

Closure

Thus, we hope this text has supplied priceless insights into Understanding Your Calendar 12 months Deductible for Well being Insurance coverage. We thanks for taking the time to learn this text. See you in our subsequent article!