Understanding the Calendar 12 months in Insurance coverage: A Complete Information

Associated Articles: Understanding the Calendar 12 months in Insurance coverage: A Complete Information

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Understanding the Calendar 12 months in Insurance coverage: A Complete Information. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Understanding the Calendar 12 months in Insurance coverage: A Complete Information

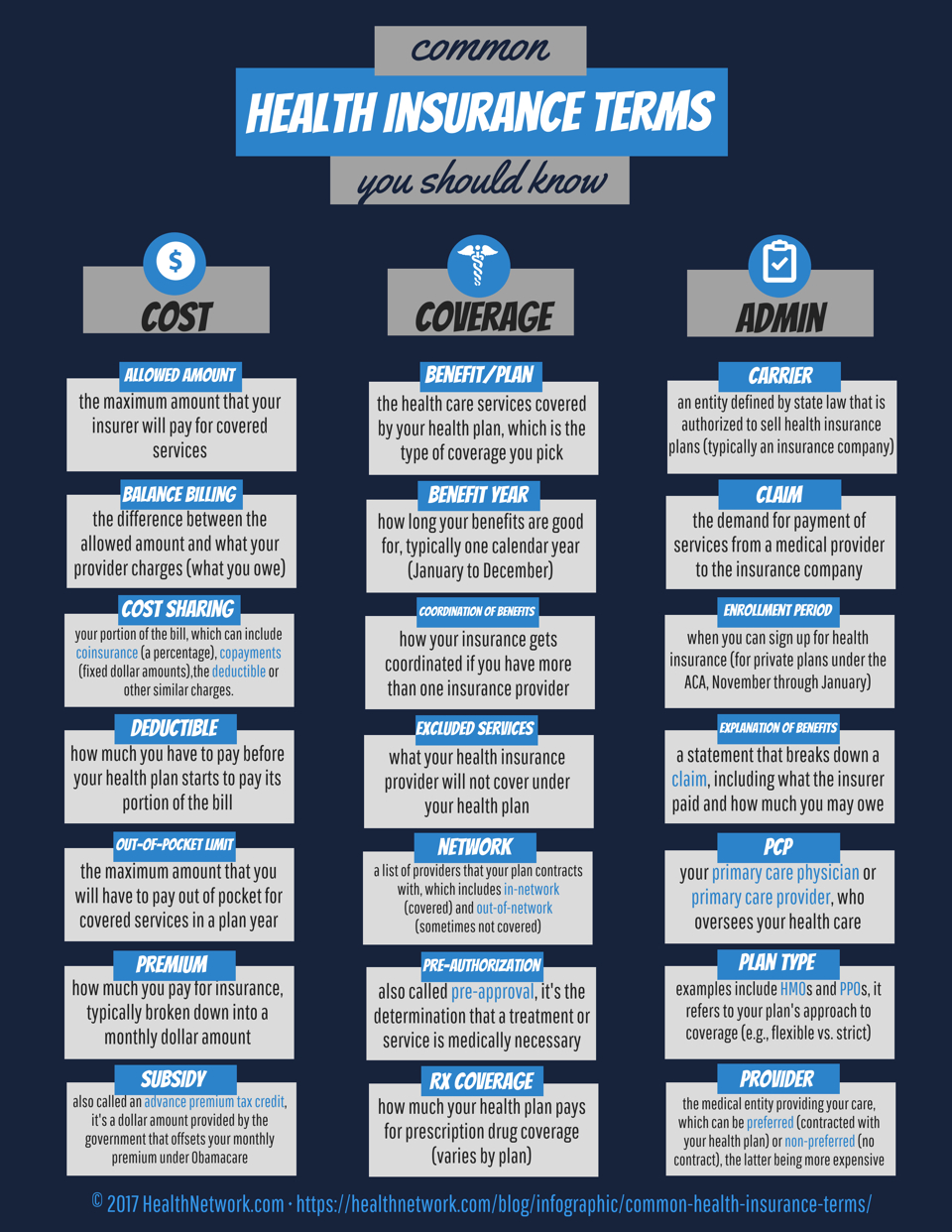

The calendar yr, a seemingly easy idea in on a regular basis life, takes on a selected and essential function within the insurance coverage trade. Understanding how the calendar yr impacts insurance coverage insurance policies is important for each insurers and policyholders, affecting premiums, claims, and general monetary planning. This text offers a complete overview of the calendar yr within the context of insurance coverage, exploring its implications throughout varied insurance coverage varieties and highlighting key issues for people and companies.

Defining the Calendar 12 months in Insurance coverage

In insurance coverage, the calendar yr refers back to the interval from January 1st to December thirty first of a given yr. Whereas seemingly simple, its significance lies in its use as a standardized timeframe for varied insurance-related actions. This contains:

- Premium Calculations: Many insurance coverage insurance policies use the calendar yr as the premise for calculating annual premiums. Which means the premium is usually due annually, typically at first of the calendar yr, though fee schedules can differ relying on the insurer and coverage sort.

- Declare Reporting and Processing: The calendar yr typically serves as a reference level for monitoring and processing claims. Insurers may mixture claims knowledge on a calendar-year foundation for statistical evaluation, danger evaluation, and charge changes. Particular coverage provisions may additionally tie declare limits or deductibles to the calendar yr.

- Coverage Renewals: Whereas not universally the case, many insurance coverage insurance policies renew on the anniversary of their inception date, which could or won’t align with the calendar yr. Nevertheless, the calendar yr performs a job in figuring out the renewal premium, which frequently displays the insurer’s evaluation of danger primarily based on the previous calendar yr’s knowledge.

- Tax Reporting: For companies, insurance coverage premiums paid through the calendar yr are sometimes deductible bills, impacting their general tax legal responsibility. Equally, insurance coverage payouts obtained through the calendar yr are reported as revenue or reimbursements, relying on the specifics of the coverage and the character of the declare.

Calendar 12 months vs. Coverage 12 months:

It is essential to distinguish between the calendar yr and the coverage yr. The coverage yr refers back to the interval lined by a selected insurance coverage coverage, usually beginning on the coverage’s inception date and ending on its expiration date. Whereas these dates typically align with the calendar yr, they do not at all times coincide. A coverage may begin mid-year and run for twelve months, spanning two calendar years. This distinction is important for understanding protection durations and declare eligibility.

Calendar 12 months’s Influence on Completely different Insurance coverage Sorts:

The calendar yr’s affect varies throughout completely different insurance coverage varieties:

- Auto Insurance coverage: Whereas premiums are sometimes paid yearly, the calendar yr may affect deductible resets or the buildup of accident-free years for premium reductions. Claims are usually processed whatever the calendar yr, however aggregated knowledge inside a calendar yr helps insurers analyze tendencies and alter charges.

- Householders Insurance coverage: Much like auto insurance coverage, the calendar yr serves as a reference level for premium calculations and renewals. Claims are dealt with individually, however insurers make the most of calendar-year knowledge to evaluate dangers and alter premiums for the following coverage yr. Deductibles usually reset yearly, often at first of the coverage yr, which could or won’t be the start of the calendar yr.

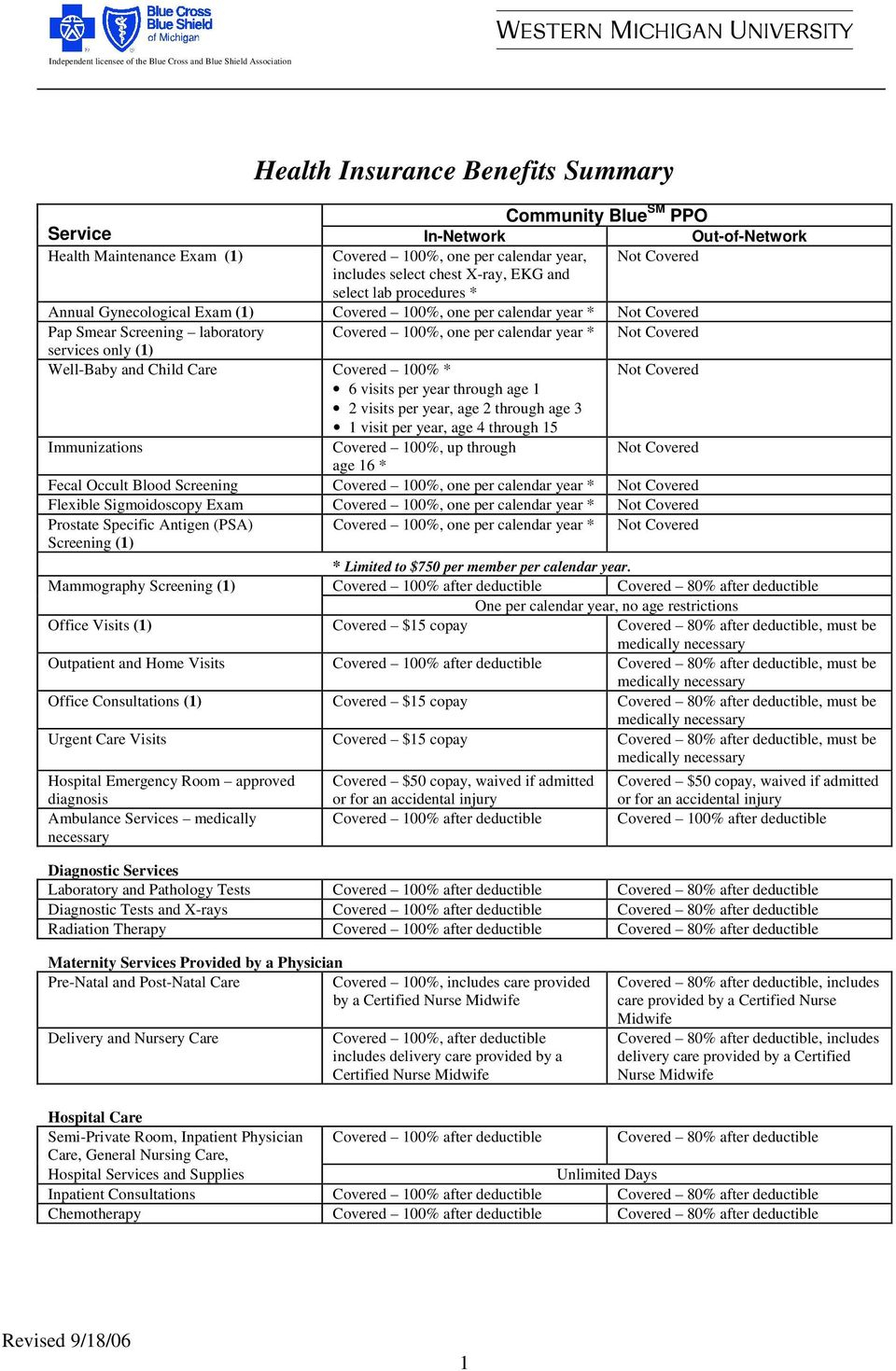

- Well being Insurance coverage: The calendar yr performs a big function in medical insurance, particularly within the context of deductibles, out-of-pocket maximums, and co-pays. These limits typically reset at first of the calendar yr. Which means even when a coverage’s anniversary date is completely different, the affected person’s cost-sharing tasks are sometimes tied to the calendar yr. Moreover, many employers provide medical insurance advantages primarily based on the calendar yr.

- Life Insurance coverage: The calendar yr is much less crucial in life insurance coverage in comparison with different varieties. Premiums are usually paid yearly or extra regularly, however the coverage’s protection stays unaffected by the calendar yr’s boundaries. Nevertheless, the calendar yr may influence tax reporting associated to life insurance coverage premiums and payouts.

- Industrial Insurance coverage: For companies, the calendar yr is essential for budgeting, monetary reporting, and tax planning. Premiums are sometimes calculated yearly, and claims knowledge is regularly analyzed on a calendar-year foundation to evaluate danger and negotiate future premiums.

Key Concerns for Policyholders:

Understanding the calendar yr’s implications permits policyholders to:

- Plan for Premium Funds: Realizing when premiums are due permits for budgeting and well timed funds to keep away from penalties or coverage lapses.

- Monitor Declare Limits and Deductibles: Consciousness of calendar-year resets for deductibles and different limits helps handle out-of-pocket bills.

- Optimize Tax Deductions: Correctly monitoring insurance coverage premiums paid through the calendar yr allows correct tax reporting and potential tax financial savings.

- Perceive Renewal Dates: Being conscious of coverage renewal dates, even when they do not align with the calendar yr, ensures steady protection.

- Evaluate Coverage Paperwork: Fastidiously reviewing coverage paperwork to know the precise phrases and circumstances associated to the calendar yr is essential for efficient administration of insurance coverage protection.

Implications for Insurers:

For insurers, the calendar yr is crucial for:

- Danger Evaluation: Aggregating claims knowledge on a calendar-year foundation permits for correct danger evaluation and charge changes.

- Monetary Planning: Predicting premium revenue and declare payouts primarily based on calendar-year knowledge is essential for monetary stability.

- Regulatory Compliance: Many regulatory necessities necessitate reporting insurance coverage knowledge on a calendar-year foundation.

- Product Growth: Understanding calendar-year tendencies helps insurers develop and refine insurance coverage merchandise to fulfill evolving buyer wants.

- Aggressive Benefit: Efficient utilization of calendar-year knowledge can present a aggressive benefit in pricing and product choices.

Conclusion:

The calendar yr performs a big, albeit typically understated, function within the insurance coverage trade. Whereas seemingly a easy idea, its implications are far-reaching, affecting premium calculations, declare processing, coverage renewals, and tax reporting. Understanding the nuances of the calendar yr’s affect on completely different insurance coverage varieties is essential for each policyholders and insurers to handle dangers, optimize prices, and make knowledgeable selections. By rigorously contemplating the calendar yr’s influence, people and companies can guarantee they’ve ample insurance coverage protection and leverage the system successfully to their profit. Common assessment of coverage paperwork and communication with insurers stay key to making sure a transparent understanding of how the calendar yr impacts particular person insurance coverage wants.

Closure

Thus, we hope this text has offered useful insights into Understanding the Calendar 12 months in Insurance coverage: A Complete Information. We thanks for taking the time to learn this text. See you in our subsequent article!