Understanding the Calendar 12 months Deductible: A Complete Information

Associated Articles: Understanding the Calendar 12 months Deductible: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Understanding the Calendar 12 months Deductible: A Complete Information. Let’s weave fascinating info and supply recent views to the readers.

Desk of Content material

Understanding the Calendar 12 months Deductible: A Complete Information

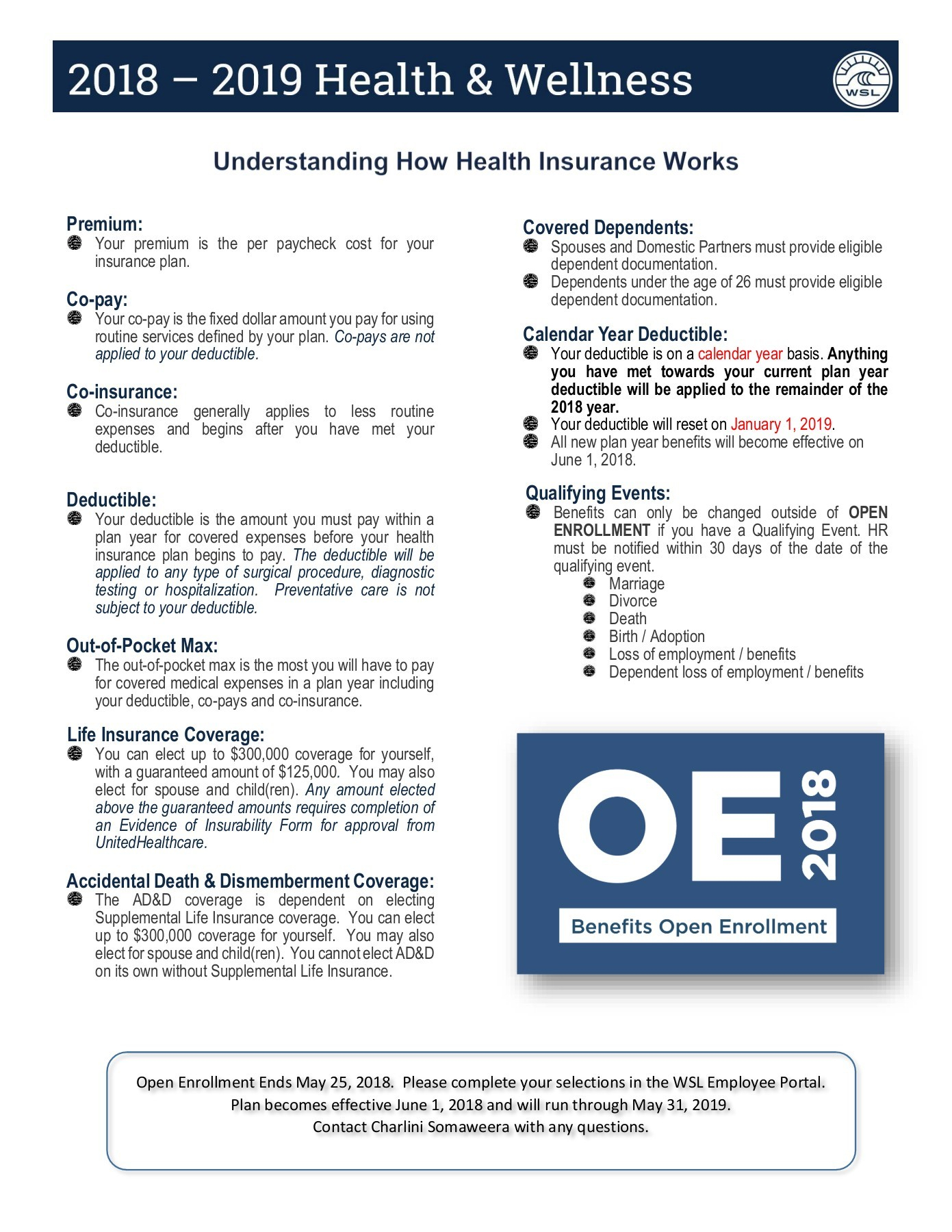

The time period "calendar 12 months deductible" is ceaselessly encountered within the context of medical health insurance, auto insurance coverage, and even some home-owner’s insurance coverage insurance policies. Whereas the idea is comparatively easy, its implications will be important for people and households managing their insurance coverage prices and planning for sudden bills. This text will present a complete clarification of the calendar 12 months deductible, exploring its which means, the way it works, its impression on out-of-pocket bills, and the way it differs from different deductible constructions.

What’s a Calendar 12 months Deductible?

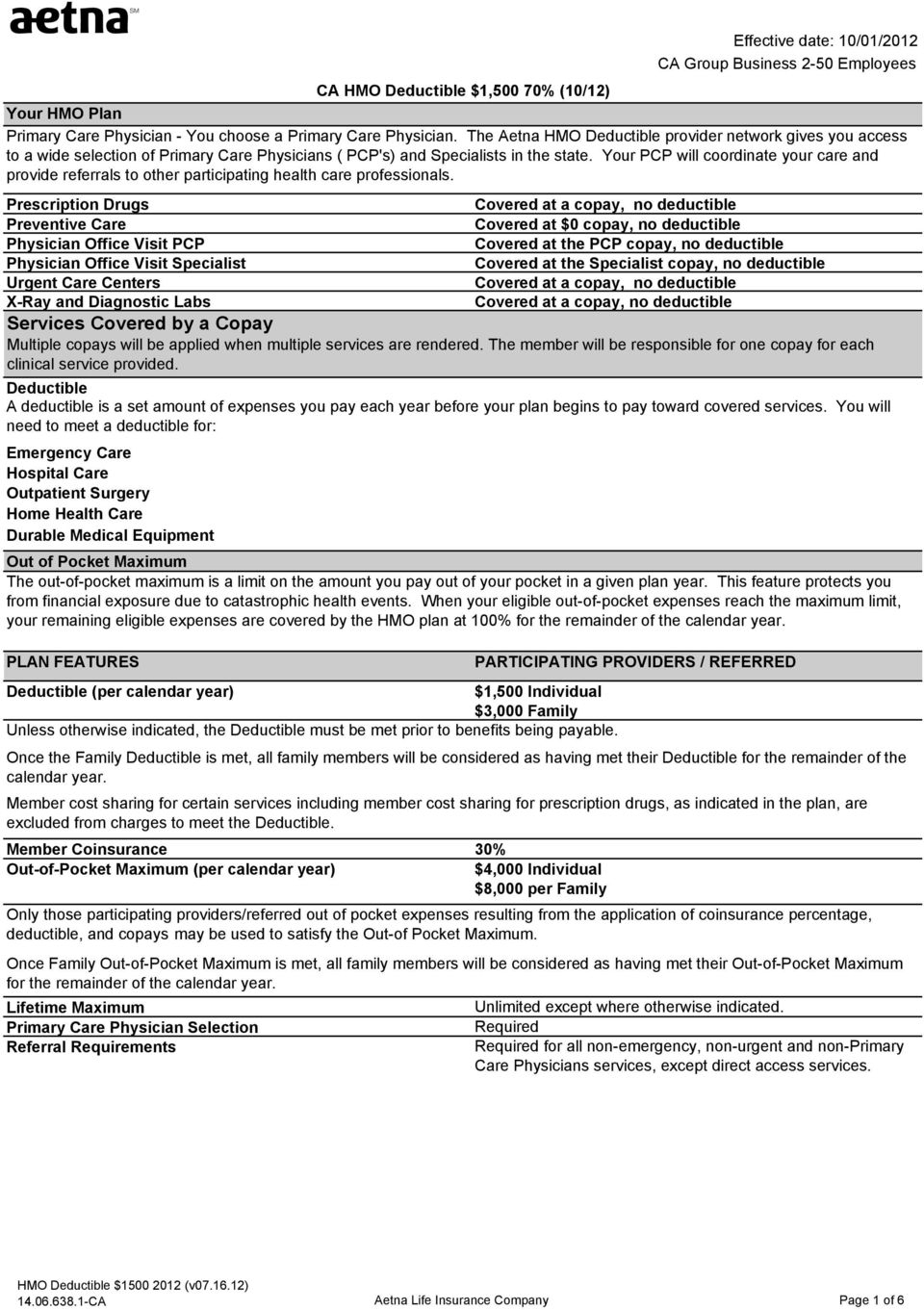

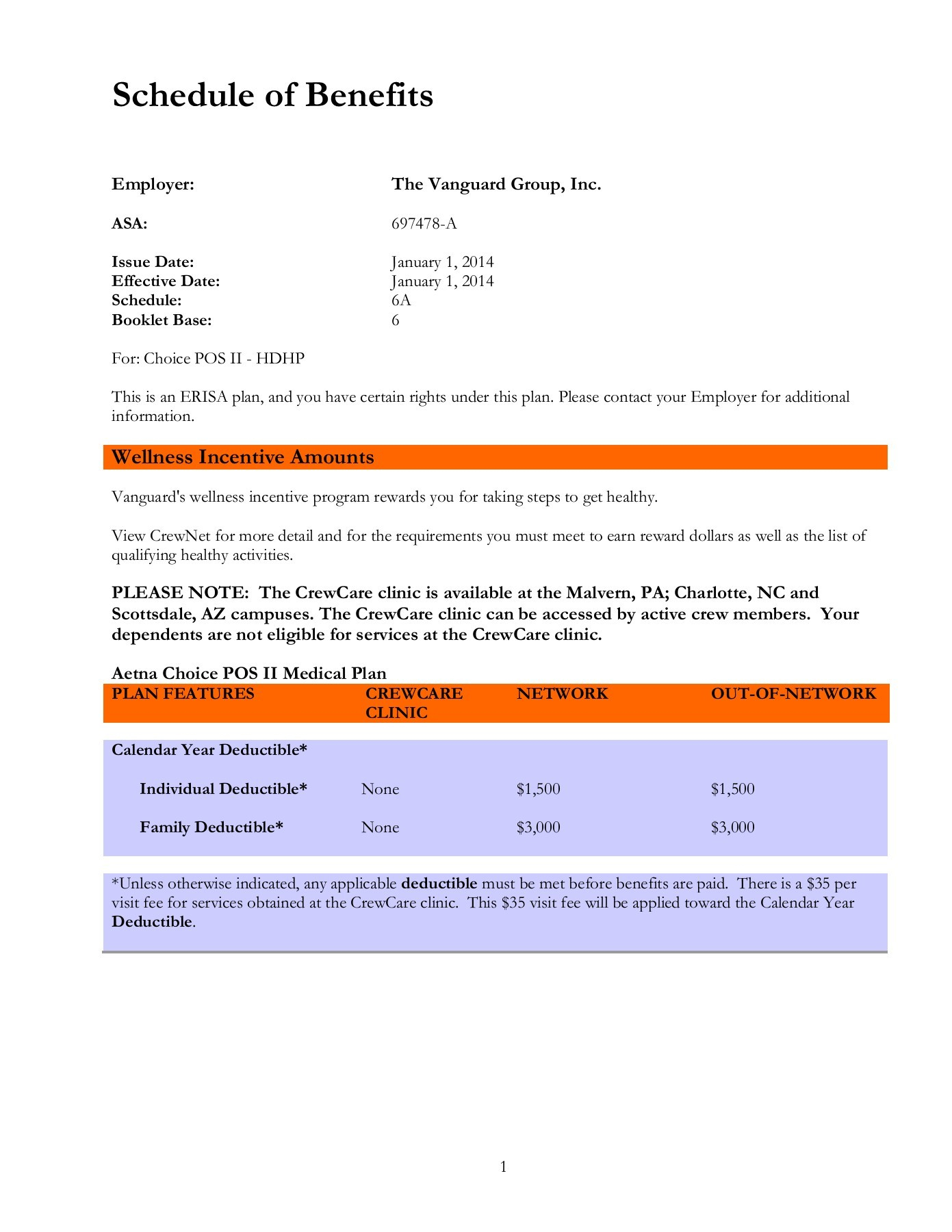

A calendar 12 months deductible is the sum of money you could pay out-of-pocket for lined healthcare bills, lined auto restore bills, or lined residence restore bills earlier than your insurance coverage firm begins to pay its share. Crucially, the "calendar 12 months" side refers back to the interval of January 1st to December thirty first. This implies the deductible resets initially of every new 12 months. When you meet your deductible, your insurance coverage firm will usually cowl a portion of your remaining eligible bills for the remainder of the 12 months, in accordance with your coverage’s phrases. Nevertheless, the following 12 months, you may begin once more from zero.

How a Calendar 12 months Deductible Works in Completely different Insurance coverage Varieties:

Let’s look at how this deductible features throughout various kinds of insurance coverage:

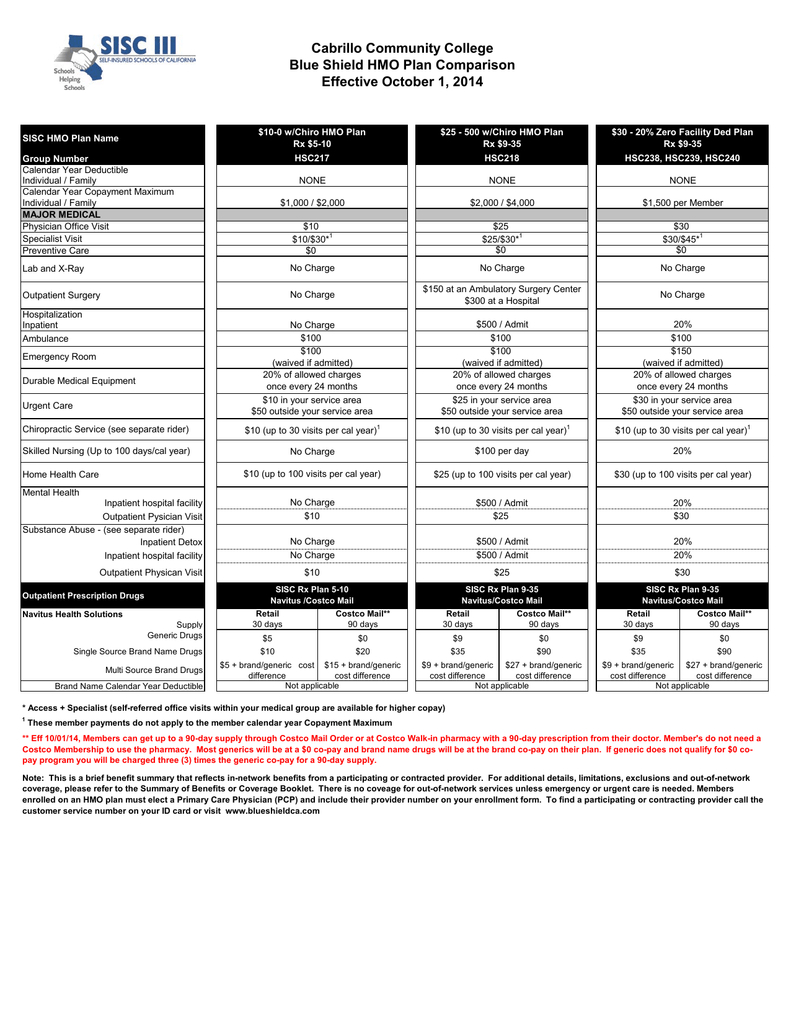

1. Well being Insurance coverage:

In medical health insurance, the calendar 12 months deductible is maybe probably the most generally encountered. Think about you will have a medical health insurance plan with a $2,000 calendar 12 months deductible. This implies you may be accountable for the primary $2,000 of lined medical bills in the course of the 12 months. This might embody physician visits, hospital stays, prescribed drugs, and different lined companies. As soon as you have met the $2,000 deductible, your insurance coverage firm will usually begin paying its share of the prices, primarily based in your plan’s coinsurance proportion and out-of-pocket most. Nevertheless, in case you incur additional medical bills in the identical calendar 12 months that exceed your deductible, your insurance coverage protection will apply. In the beginning of the brand new 12 months, your deductible resets to $2,000.

Instance:

- January: You’ve gotten a health care provider’s go to costing $150. Your out-of-pocket expense is $150.

- February: You require emergency room remedy costing $1,500. Your out-of-pocket expense is now $1,650 ($150 + $1,500).

- March: You want a prescription costing $350. Your out-of-pocket expense is now $2,000 ($1,650 + $350). You’ve gotten met your deductible.

- April: You’ve gotten a follow-up appointment costing $100. Your insurance coverage will now cowl a portion of this price, relying in your plan’s coinsurance. You’ll solely pay your copay or coinsurance quantity.

2. Auto Insurance coverage:

In auto insurance coverage, the calendar 12 months deductible normally applies to collision and complete protection. Which means in case you are concerned in an accident and have to restore your automotive, you may be accountable for the primary quantity of the deductible earlier than your insurance coverage firm covers the remaining prices. As an example, a $500 deductible means you may pay the primary $500 of restore prices, and your insurance coverage will cowl the remaining (as much as your coverage limits). Once more, this deductible resets initially of every new 12 months. It is vital to notice that legal responsibility protection (overlaying damages to others) normally would not contain a deductible.

3. Home-owner’s Insurance coverage:

Whereas much less widespread, some home-owner’s insurance coverage insurance policies might need a calendar 12 months deductible for sure sorts of claims, equivalent to these associated to wind injury or hail injury. This implies you’d pay the deductible earlier than your insurance coverage firm covers the remainder of the restore prices. Different sorts of claims, like these associated to theft, might need separate deductibles or completely different deductible constructions.

Calendar 12 months Deductible vs. Different Deductible Buildings:

It is essential to tell apart the calendar 12 months deductible from different deductible constructions. Some insurance policies could use:

- Per-incident deductible: You pay a deductible for every separate incident or declare, whatever the calendar 12 months.

- Per-claim deductible: Just like per-incident, this is applicable a separate deductible for every separate declare, no matter the calendar 12 months.

- Rolling deductible: This deductible tracks bills over a specified interval, normally 12 months, however the interval rolls ahead with every passing month. As soon as the deductible is met, the interval restarts.

Understanding the particular deductible construction of your coverage is important to precisely predicting your out-of-pocket bills.

Elements Affecting the Calendar 12 months Deductible:

The quantity of your calendar 12 months deductible is influenced by a number of elements:

- Insurance coverage plan sort: Greater deductible plans usually have decrease premiums, whereas decrease deductible plans normally have increased premiums.

- Insurance coverage supplier: Completely different insurance coverage firms supply various deductible choices.

- Protection stage: The extent of protection you select will impression your deductible. Extra complete protection could lead to the next deductible.

- Geographic location: Deductibles can range primarily based in your location attributable to variations in danger elements.

Managing Your Calendar 12 months Deductible:

A number of methods may also help you handle your calendar 12 months deductible:

- Budgeting: Precisely estimate your potential healthcare, auto restore, or residence restore bills and incorporate your deductible into your annual price range.

- Well being Financial savings Account (HSA): When you’ve got a high-deductible well being plan, an HSA may also help you save pre-tax cash to pay for medical bills, together with your deductible.

- Emergency fund: Sustaining an emergency fund can present a security web to cowl sudden bills earlier than your deductible is met.

- Overview your coverage: Fastidiously evaluation your insurance coverage coverage to totally perceive the phrases and situations associated to your deductible.

Conclusion:

The calendar 12 months deductible is a elementary aspect of many insurance coverage insurance policies. Understanding its which means, the way it works, and its implications on your out-of-pocket bills is essential for accountable monetary planning. By fastidiously contemplating your deductible quantity, choosing the proper insurance coverage plan, and implementing efficient budgeting methods, you possibly can higher handle the prices related to sudden occasions and make sure you’re ready for the monetary implications of your deductible. Bear in mind to all the time seek the advice of your insurance coverage coverage paperwork or contact your insurance coverage supplier if in case you have any questions or require clarification concerning your particular deductible and its utility.

Closure

Thus, we hope this text has offered worthwhile insights into Understanding the Calendar 12 months Deductible: A Complete Information. We recognize your consideration to our article. See you in our subsequent article!