Navigating the Wash Sale Rule: Understanding the 30-Day Window and Minimizing Tax Liabilities

Associated Articles: Navigating the Wash Sale Rule: Understanding the 30-Day Window and Minimizing Tax Liabilities

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Navigating the Wash Sale Rule: Understanding the 30-Day Window and Minimizing Tax Liabilities. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Navigating the Wash Sale Rule: Understanding the 30-Day Window and Minimizing Tax Liabilities

The Inner Income Service (IRS) wash sale rule is an important side of US tax regulation that impacts buyers who purchase and promote securities at a loss. Designed to stop taxpayers from artificially creating tax losses, this rule dictates that losses on the sale of securities can’t be deducted if considerably similar securities are bought inside a selected timeframe. This timeframe is an important 30-day window, extending from 30 days earlier than the sale to 30 days after the sale. Understanding the intricacies of the wash sale rule, notably this 30-day interval, is crucial for buyers looking for to optimize their tax methods and keep away from penalties.

This text delves deep into the wash sale rule, specializing in the 30-day interval, its implications, and methods to navigate this regulation successfully. We are going to discover what constitutes a "considerably similar" safety, look at frequent eventualities the place the rule applies, and supply sensible recommendation on how you can plan your trades to attenuate the impression of the wash sale rule in your tax legal responsibility.

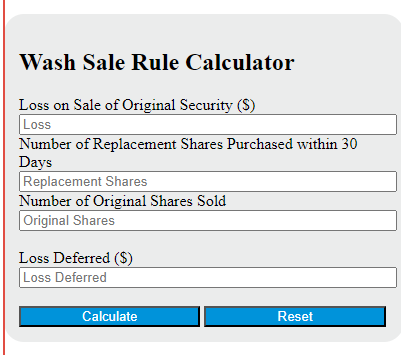

Defining the Wash Sale Rule and the 30-Day Window

The wash sale rule, codified beneath Part 1091 of the Inner Income Code, states {that a} loss from the sale or commerce of inventory or securities can’t be deducted if, inside a interval starting 30 days earlier than the date of such sale or commerce and ending 30 days after such date, the taxpayer acquires considerably similar inventory or securities. Which means the loss just isn’t instantly deductible, however fairly is added to the idea of the newly acquired securities. This successfully postpones the popularity of the loss till the brand new securities are ultimately offered.

The 30-day window is important. It is not simply in regards to the day of the sale; it encompasses your complete interval surrounding it. A sale on January fifteenth, for instance, triggers the wash sale rule if considerably similar securities are bought between December sixteenth of the earlier 12 months and February 14th of the present 12 months. This complete timeframe necessitates cautious planning and record-keeping.

What Constitutes "Considerably Equivalent" Securities?

The definition of "considerably similar" is essential for understanding the scope of the wash sale rule. Whereas the IRS does not present a inflexible definition, typically, securities are thought-about considerably similar if they’re readily interchangeable. This consists of:

- Identical inventory or safety: Shopping for the identical shares of the identical firm’s inventory throughout the 30-day window after promoting related shares is a transparent violation.

- Completely different courses of the identical inventory: For instance, promoting Class A shares and shopping for Class B shares of the identical firm throughout the 30-day interval would doubtless set off the wash sale rule. The secret is whether or not the financial traits are primarily the identical.

- Choices and warrants: Shopping for name choices or warrants on the identical underlying inventory throughout the 30-day interval after promoting the inventory itself is taken into account a wash sale.

- Futures contracts: Buying and selling futures contracts on the identical underlying asset throughout the 30-day window after promoting the asset may set off the rule.

- Completely different issuers however related traits: In sure circumstances, securities issued by completely different firms however with very related traits (e.g., ETFs monitoring the identical index) may be thought-about considerably similar. It is a extra nuanced space and requires cautious consideration.

Frequent Eventualities Triggering the Wash Sale Rule

A number of frequent funding eventualities can inadvertently set off the wash sale rule:

- Promoting at a loss and instantly repurchasing: That is probably the most easy instance. An investor promoting shares at a loss and shopping for the identical shares the subsequent day will clearly violate the rule.

- Promoting and shopping for barely completely different securities: As talked about earlier, buying barely completely different courses of shares or related ETFs may set off the rule.

- Promoting a portion of holdings and repurchasing: Even promoting solely a portion of your holdings and shopping for again the same quantity throughout the 30-day interval can nonetheless set off the wash sale rule.

- Utilizing a brokerage account and a retirement account: The wash sale rule applies whatever the account used. Promoting shares in a taxable brokerage account and shopping for the identical shares in a retirement account (or vice-versa) throughout the 30-day interval will nonetheless set off the rule.

Methods for Minimizing the Impression of the Wash Sale Rule

Whereas the wash sale rule can’t be solely prevented, buyers can make use of methods to attenuate its impression:

- Lengthen the holding interval: The best answer is to attend greater than 30 days earlier than repurchasing considerably similar securities. This enables the loss to be acknowledged within the present tax 12 months.

- Buy completely different securities: Investing in securities that aren’t considerably similar to those offered can keep away from triggering the rule. This requires cautious consideration of your funding targets and threat tolerance.

- Detailed record-keeping: Keep meticulous data of all of your trades, together with dates, portions, and safety identifiers. That is essential for precisely calculating your tax legal responsibility and avoiding potential audits.

- Seek the advice of a tax skilled: For advanced funding methods or conditions involving a number of accounts, consulting a tax skilled is very beneficial. They will present tailor-made recommendation based mostly in your particular circumstances.

- Contemplate tax-loss harvesting: Tax-loss harvesting is a technique that includes strategically promoting dropping investments to offset capital beneficial properties, nevertheless it requires cautious planning to keep away from triggering the wash sale rule. This technique is greatest applied with the steering of a monetary advisor or tax skilled.

Penalties of Violating the Wash Sale Rule

Violating the wash sale rule does not lead to penalties, nevertheless it does postpone the deduction of the loss. The disallowed loss is added to the idea of the brand new, considerably similar securities, growing their value foundation. Which means when these new securities are ultimately offered, the acquire or loss will mirror the adjusted foundation, doubtlessly decreasing the general tax financial savings in comparison with deducting the loss instantly.

Conclusion

The wash sale rule, with its 30-day window, is an important side of US tax regulation that impacts buyers’ tax liabilities. Understanding this rule and its implications is paramount for buyers who purchase and promote securities, notably those that commerce often. By rigorously planning trades, sustaining correct data, and looking for skilled recommendation when crucial, buyers can navigate the wash sale rule successfully and reduce its impression on their general tax obligations. Bear in mind, the 30-day window is a important issue, and ignoring it may result in unintended tax penalties. Proactive planning and a focus to element are key to profitable tax administration within the context of the wash sale rule.

Closure

Thus, we hope this text has offered priceless insights into Navigating the Wash Sale Rule: Understanding the 30-Day Window and Minimizing Tax Liabilities. We respect your consideration to our article. See you in our subsequent article!