Navigating the Ohio Payroll Calendar: A Complete Information for Employers and Workers

Associated Articles: Navigating the Ohio Payroll Calendar: A Complete Information for Employers and Workers

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Navigating the Ohio Payroll Calendar: A Complete Information for Employers and Workers. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Navigating the Ohio Payroll Calendar: A Complete Information for Employers and Workers

The Ohio payroll calendar, not like a federally mandated schedule, is ruled by a mixture of state legal guidelines, employer insurance policies, and the precise wants of particular person companies. This implies there isn’t any single, universally relevant calendar. Nevertheless, understanding the important thing elements influencing payroll processing in Ohio is essential for each employers and staff to make sure correct and well timed compensation. This text delves into the intricacies of Ohio payroll, offering a complete overview of related legal guidelines, finest practices, and sources to assist navigate this important facet of employment.

Understanding the Fundamentals of Ohio Payroll:

Ohio, like all states, adheres to federal payroll tax laws, together with the deduction of Social Safety and Medicare taxes. Nevertheless, the state additionally has its personal distinctive tax construction, impacting the payroll course of. Understanding these nuances is important to keep away from penalties and guarantee compliance.

Key Parts of Ohio Payroll:

-

Ohio Earnings Tax: Ohio operates a progressive revenue tax system, that means the tax price will increase with larger revenue ranges. Employers are liable for withholding Ohio revenue tax from worker wages primarily based on their W-4 varieties and the relevant tax brackets. The Ohio Division of Taxation supplies detailed info and withholding tables to help employers in correct calculation.

-

Native Earnings Taxes: Many Ohio cities and municipalities levy their very own revenue taxes, including one other layer of complexity to payroll. These native taxes range considerably, and employers should decide which native taxes apply primarily based on the worker’s work location and residency. Failing to correctly account for native revenue taxes can lead to important penalties.

-

Unemployment Insurance coverage (UI): Ohio’s unemployment insurance coverage program supplies advantages to eligible staff who lose their jobs via no fault of their very own. Employers contribute to the UI fund via a tax primarily based on their payroll. The tax price varies relying on the employer’s expertise ranking, reflecting their historical past of unemployment claims.

-

Staff’ Compensation: Ohio’s staff’ compensation system supplies medical advantages and wage alternative to staff injured on the job. Employers are required to hold staff’ compensation insurance coverage, and the premiums are sometimes calculated primarily based on the employer’s payroll and business classification.

-

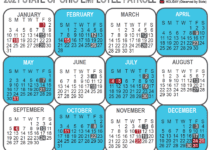

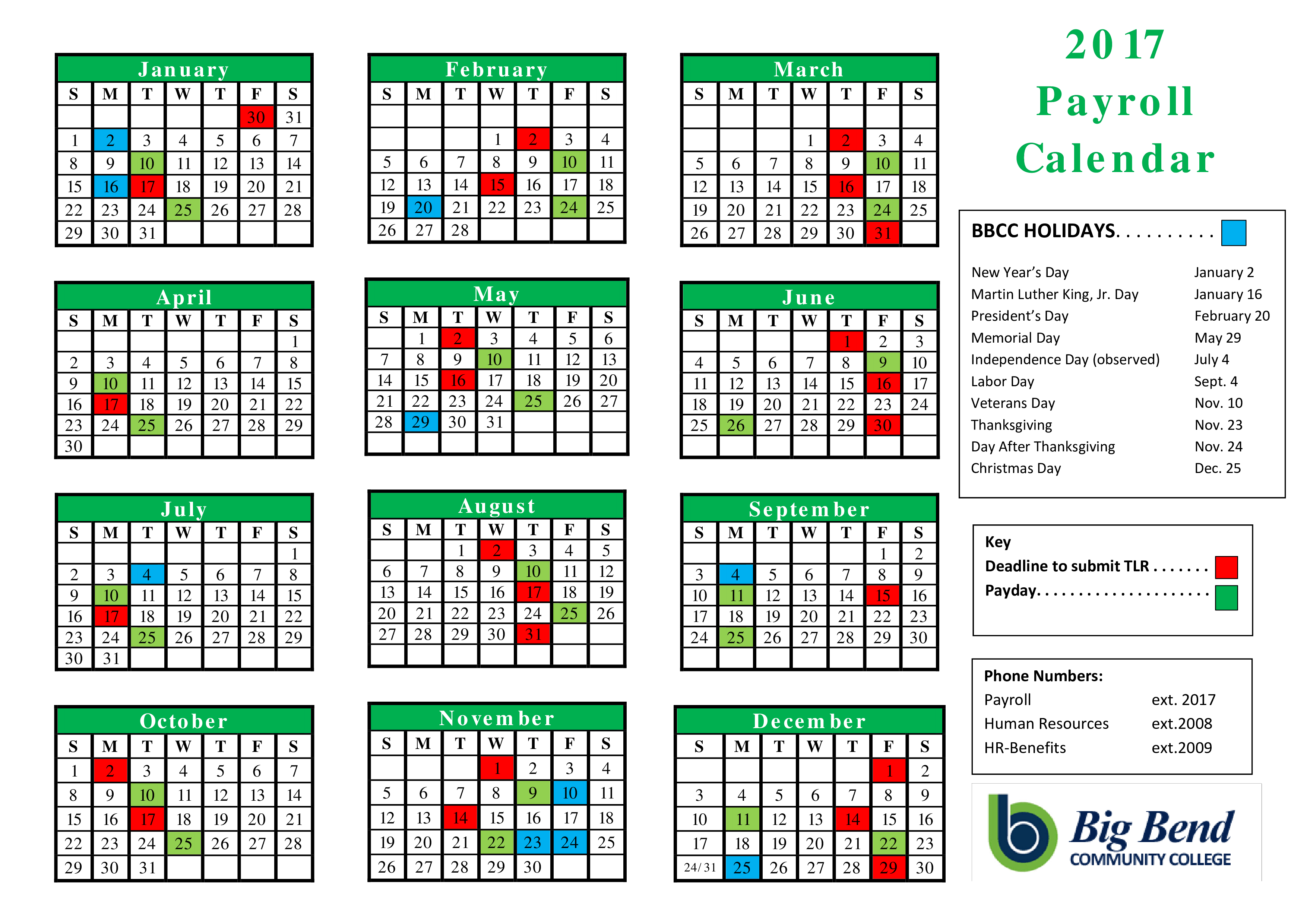

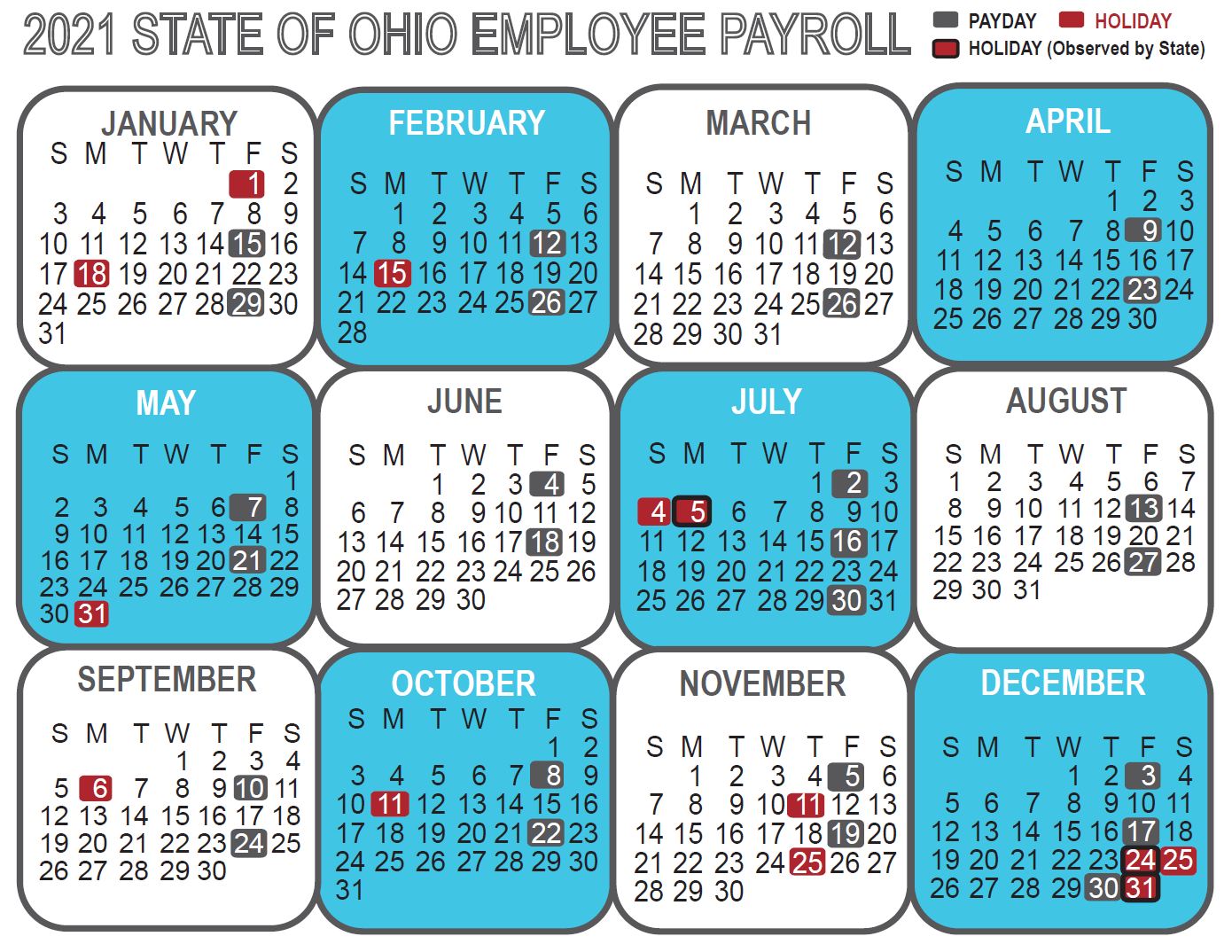

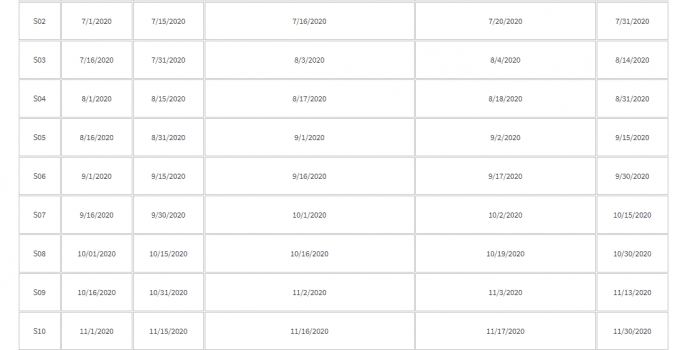

Payroll Frequency: Whereas there isn’t any state mandate dictating payroll frequency, most Ohio employers pay their staff weekly, bi-weekly, semi-monthly, or month-to-month. The chosen frequency must be clearly communicated to staff and constantly adopted.

Creating an Ohio Payroll Calendar:

Since there isn’t any official state payroll calendar, employers should create their very own, making an allowance for varied elements:

-

Payroll Frequency: The chosen frequency dictates the variety of payroll intervals in a 12 months. A weekly payroll could have 52 pay intervals, whereas a bi-weekly payroll could have 26.

-

Payday: Employers should choose a constant payday inside their chosen frequency. This must be clearly communicated to staff and adhered to constantly. Many employers select a particular day of the week (e.g., each Friday) or a particular date throughout the pay interval (e.g., the fifteenth and the final day of the month).

-

Tax Deadlines: Ohio’s revenue tax withholding deadlines align with the federal deadlines. Nevertheless, employers ought to pay attention to any potential variations and guarantee well timed remittance of taxes to keep away from penalties.

-

Reporting Deadlines: Employers are required to file varied payroll studies with state and federal companies. These studies embody quarterly and annual tax returns. Understanding and adhering to those deadlines is essential for compliance.

-

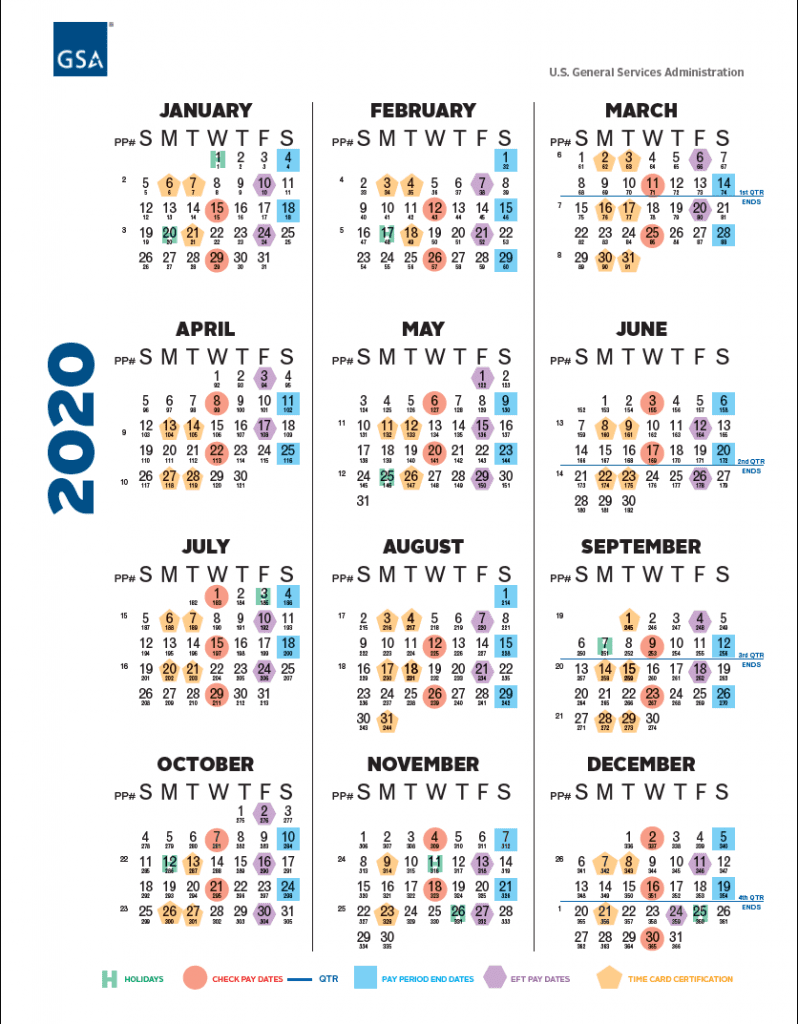

Vacation Concerns: Employers ought to account for holidays when creating their payroll calendar. This will likely contain adjusting paydays or offering extra paid break day to staff.

-

12 months-Finish Processing: 12 months-end payroll processing includes issuing W-2 varieties to staff and submitting varied tax returns. Employers ought to plan properly upfront to make sure correct and well timed completion of those duties.

Greatest Practices for Ohio Payroll Administration:

-

Make the most of Payroll Software program: Payroll software program can considerably simplify the payroll course of, automating many duties and lowering the danger of errors. Many software program choices supply options particular to Ohio payroll laws.

-

Preserve Correct Data: Meticulous record-keeping is important for compliance and dispute decision. Employers ought to keep detailed information of worker wages, deductions, and tax funds.

-

Keep Up to date on Tax Legal guidelines: Ohio tax legal guidelines are topic to vary. Employers ought to keep knowledgeable about any updates to keep away from non-compliance. Assets just like the Ohio Division of Taxation web site are helpful instruments for staying present.

-

Search Skilled Help: For advanced payroll conditions, it is advisable to hunt skilled help from a payroll specialist or accountant. They’ll present steering on compliance and assist navigate difficult conditions.

Assets for Ohio Payroll Data:

-

Ohio Division of Taxation: The first supply for info on Ohio revenue tax withholding and different tax-related issues.

-

Ohio Bureau of Staff’ Compensation: Offers info on staff’ compensation insurance coverage necessities and advantages.

-

Ohio Division of Job and Household Providers: Handles unemployment insurance coverage issues, together with employer contributions and profit claims.

-

IRS: The Inner Income Service supplies info on federal payroll tax laws.

Worker Concerns:

Workers ought to familiarize themselves with their employer’s payroll schedule and perceive how their wages are calculated, together with all deductions. If discrepancies come up, staff ought to promptly contact their employer’s payroll division to resolve any points. Understanding their pay stubs and W-2 varieties is essential for correct tax submitting.

Conclusion:

Managing payroll in Ohio requires cautious consideration to element and adherence to each federal and state laws. By understanding the important thing parts of Ohio payroll, making a well-structured payroll calendar, and using obtainable sources, employers can guarantee correct and well timed compensation for his or her staff whereas sustaining compliance. Often reviewing and updating payroll processes, and in search of skilled help when wanted, are essential steps in successfully managing this important facet of enterprise operations. For workers, understanding their pay stubs and using obtainable sources to make clear any uncertainties ensures a easy and clear compensation course of. Proactive planning and adherence to finest practices are key to a profitable and compliant payroll system in Ohio.

Closure

Thus, we hope this text has offered helpful insights into Navigating the Ohio Payroll Calendar: A Complete Information for Employers and Workers. We thanks for taking the time to learn this text. See you in our subsequent article!