Navigating the Minnesota Payroll Calendar: A Complete Information for Employers and Workers

Associated Articles: Navigating the Minnesota Payroll Calendar: A Complete Information for Employers and Workers

Introduction

With nice pleasure, we are going to discover the intriguing subject associated to Navigating the Minnesota Payroll Calendar: A Complete Information for Employers and Workers. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Navigating the Minnesota Payroll Calendar: A Complete Information for Employers and Workers

The Minnesota payroll calendar, not like a federally mandated schedule, is ruled by state legal guidelines relating to pay intervals, paydays, and compliance with wage and hour laws. Understanding this calendar is essential for each employers and staff within the state to make sure correct and well timed cost of wages, keep away from penalties, and preserve a constructive working relationship. This text offers a complete overview of the Minnesota payroll calendar, addressing key points like pay frequency, payday deadlines, related state legal guidelines, and sensible suggestions for each employers and staff.

Understanding Pay Frequency and Payday Deadlines:

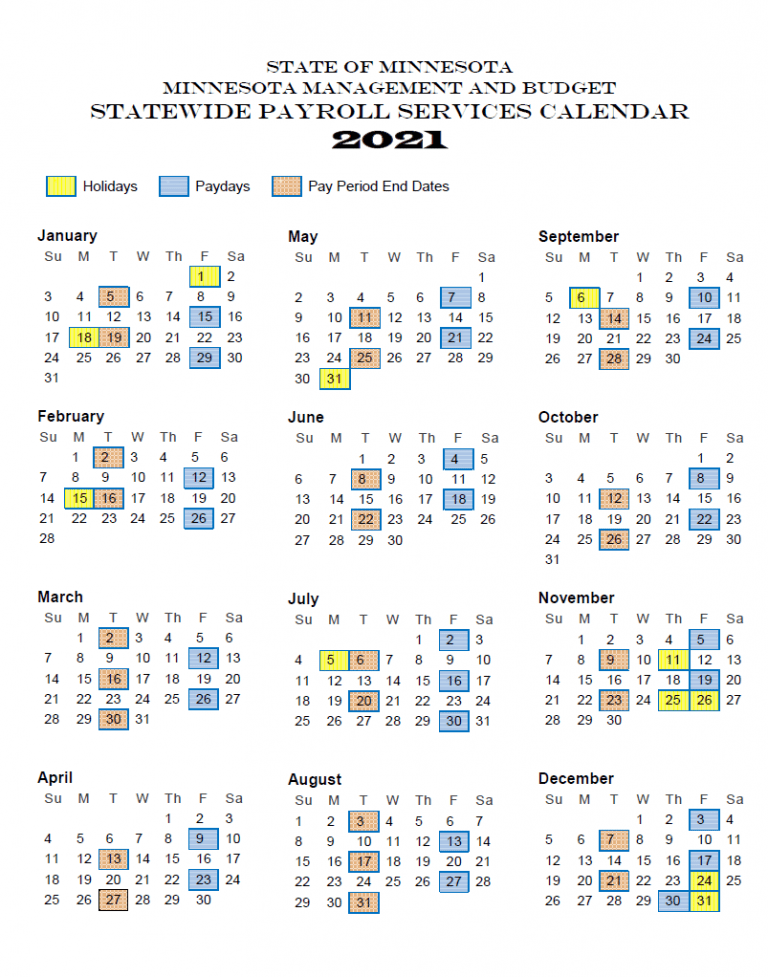

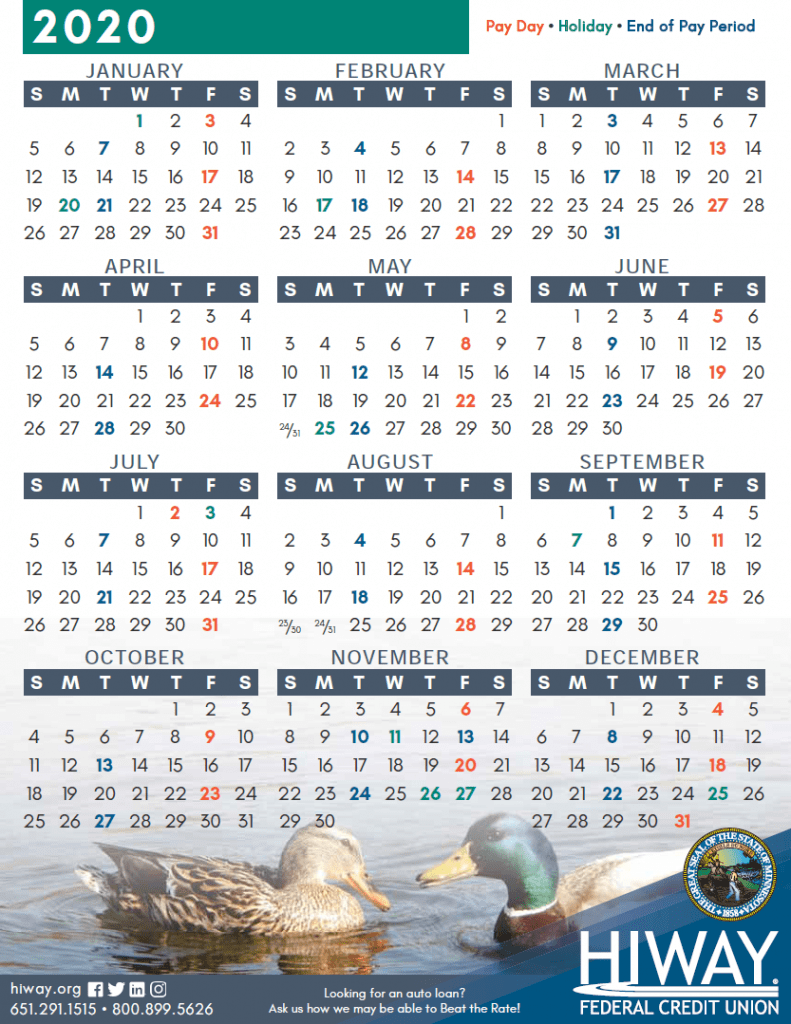

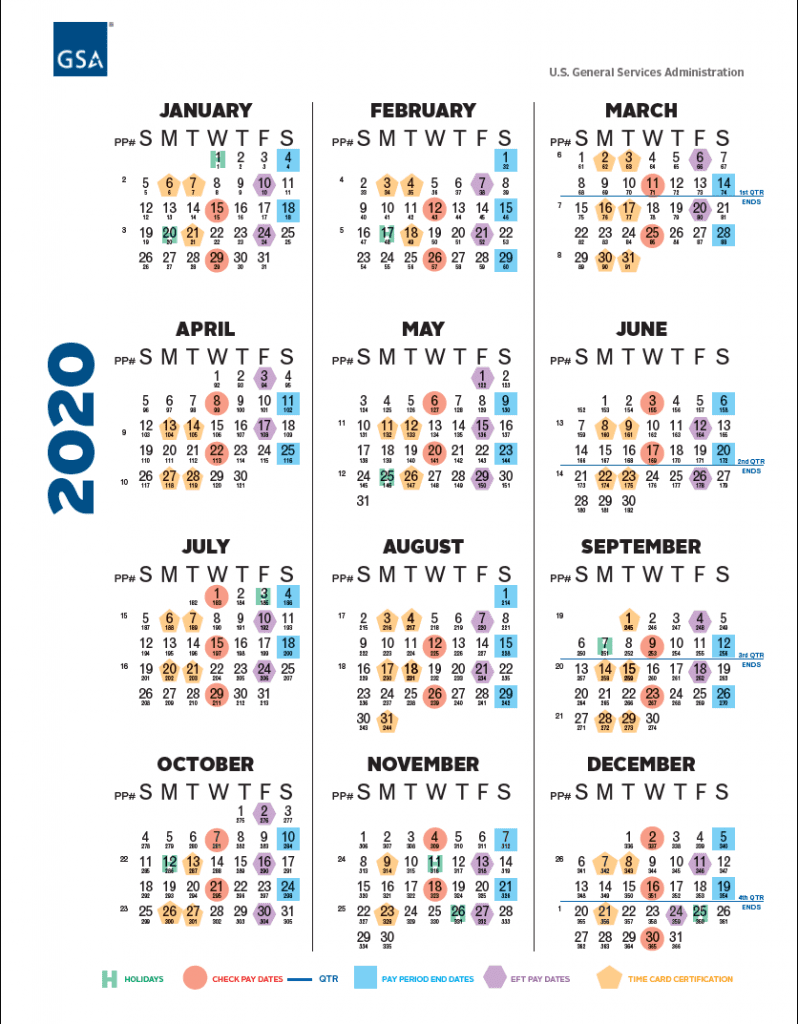

Minnesota state regulation does not mandate a selected pay frequency. Employers can select to pay their staff weekly, bi-weekly, semi-monthly, or month-to-month. Nonetheless, the chosen frequency have to be constantly utilized and clearly communicated to staff. The commonest pay frequencies in Minnesota are bi-weekly and semi-monthly.

-

Bi-weekly: Workers are paid each two weeks, leading to 26 pay intervals per yr. The precise payday can range relying on the employer’s chosen schedule.

-

Semi-monthly: Workers are paid twice a month, sometimes on the fifteenth and the final day of the month. Nonetheless, variations are doable relying on the employer’s inner calendar and the precise days of the week these dates fall on. This ends in 24 pay intervals per yr.

Whatever the chosen frequency, Minnesota regulation requires employers to pay staff at the least as soon as each month. Which means that month-to-month pay intervals are permissible, however much less frequent as a result of longer wait time for workers. Failure to stick to the established pay schedule, no matter frequency, may end up in penalties and authorized motion.

The Significance of a Constant Payroll Calendar:

Sustaining a constant and predictable payroll calendar is significant for a number of causes:

-

Worker Morale: Figuring out when to count on their paycheck permits staff to raised handle their funds, decreasing stress and bettering total morale. Inconsistency can result in monetary difficulties and dissatisfaction.

-

Correct Report Maintaining: A constant schedule simplifies record-keeping for each the employer and the worker. This makes it simpler to trace wages, taxes, and different deductions all year long.

-

Authorized Compliance: A well-defined and constantly adopted payroll calendar helps guarantee compliance with Minnesota’s wage and hour legal guidelines. This minimizes the chance of penalties and authorized disputes.

-

Monetary Planning: A predictable payroll schedule permits employers to raised handle their money move and funds for payroll bills.

Key State Legal guidelines Affecting Minnesota Payroll:

A number of Minnesota state legal guidelines straight impression payroll practices:

-

Minnesota Statutes Chapter 181: This chapter outlines the state’s wage cost legal guidelines, together with necessities for pay frequency, payday deadlines, and permissible deductions. It additionally addresses points like closing paycheck disbursement and cost for accrued trip time upon termination.

-

Minnesota Division of Labor and Trade (DLI): The DLI is accountable for implementing Minnesota’s wage and hour legal guidelines. Their web site offers helpful sources, together with steerage on payroll compliance, wage cost laws, and procedures for submitting complaints.

-

Federal Laws: Whereas Minnesota’s payroll calendar is primarily ruled by state regulation, federal laws, reminiscent of these associated to revenue tax withholding and Social Safety/Medicare taxes (FICA), additionally apply. Employers should adjust to each state and federal necessities.

Sensible Suggestions for Employers:

-

Set up a Clear Payroll Calendar: Develop a written payroll calendar and talk it clearly to all staff. This could embrace the pay frequency, payday, and any variations resulting from holidays.

-

Use Payroll Software program: Using payroll software program can automate many points of payroll processing, decreasing the chance of errors and guaranteeing well timed funds. Many software program choices provide options tailor-made to Minnesota’s particular laws.

-

Keep Correct Information: Meticulously preserve correct information of all payroll transactions, together with worker hours, wages, deductions, and funds. These information are essential for compliance audits and potential authorized disputes.

-

Keep Up to date on Authorized Modifications: Often evaluate updates to Minnesota’s wage and hour legal guidelines to make sure continued compliance. The DLI web site is a helpful useful resource for staying knowledgeable.

-

Seek the advice of with Professionals: In case you have questions or uncertainties relating to payroll compliance, seek the advice of with a payroll specialist or employment lawyer. They will present knowledgeable steerage and aid you keep away from potential authorized points.

Sensible Suggestions for Workers:

-

Perceive Your Pay Schedule: Familiarize your self together with your employer’s established payroll calendar and pay frequency. It will aid you higher handle your private funds.

-

Overview Your Pay Stub Fastidiously: Often evaluate your pay stub to make sure accuracy in your wages, deductions, and web pay. Report any discrepancies to your employer promptly.

-

Know Your Rights: Perceive your rights beneath Minnesota’s wage and hour legal guidelines. The DLI web site offers helpful data on worker rights and protections.

-

Report Violations: In the event you consider your employer is violating Minnesota’s wage and hour legal guidelines, report the violation to the DLI. They’re accountable for investigating complaints and implementing compliance.

Addressing Frequent Payroll Points in Minnesota:

-

Vacation Pay: Minnesota regulation does not mandate vacation pay. Whether or not or not staff obtain pay for holidays is dependent upon the employer’s insurance policies and employment agreements.

-

Time beyond regulation Pay: Minnesota’s time beyond regulation legal guidelines require employers to pay non-exempt staff 1.5 occasions their common price of pay for hours labored past 40 in a workweek.

-

Wage Garnishment: Minnesota regulation permits wage garnishment for varied causes, together with little one help and unpaid money owed. Employers should adjust to authorized procedures for wage garnishments.

-

Remaining Paycheck: Minnesota regulation requires employers to pay staff their closing paycheck inside a specified timeframe after termination. The precise timeframe is dependent upon the circumstances of the termination.

Conclusion:

Understanding the Minnesota payroll calendar is important for each employers and staff. By adhering to state legal guidelines, sustaining correct information, and fostering open communication, each events can guarantee a easy and compliant payroll course of. Using out there sources, such because the DLI web site and consulting with professionals when wanted, will help navigate the complexities of Minnesota’s payroll laws and preserve a constructive working relationship. Often reviewing and updating payroll procedures, coupled with a proactive strategy to compliance, will decrease dangers and contribute to a financially secure and legally sound office. Remembering that consistency and clear communication are key to a profitable payroll system will profit each employer and worker in the long term.

Closure

Thus, we hope this text has offered helpful insights into Navigating the Minnesota Payroll Calendar: A Complete Information for Employers and Workers. We hope you discover this text informative and useful. See you in our subsequent article!