Navigating the 2025 New Jersey State Payroll Calendar: A Complete Information

Associated Articles: Navigating the 2025 New Jersey State Payroll Calendar: A Complete Information

Introduction

With nice pleasure, we’ll discover the intriguing subject associated to Navigating the 2025 New Jersey State Payroll Calendar: A Complete Information. Let’s weave attention-grabbing info and supply contemporary views to the readers.

Desk of Content material

Navigating the 2025 New Jersey State Payroll Calendar: A Complete Information

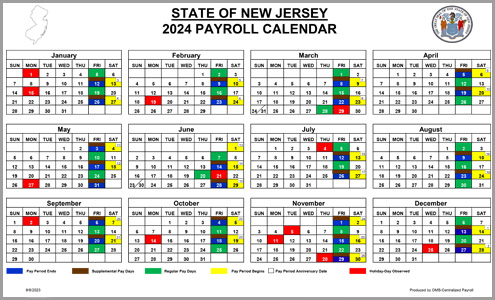

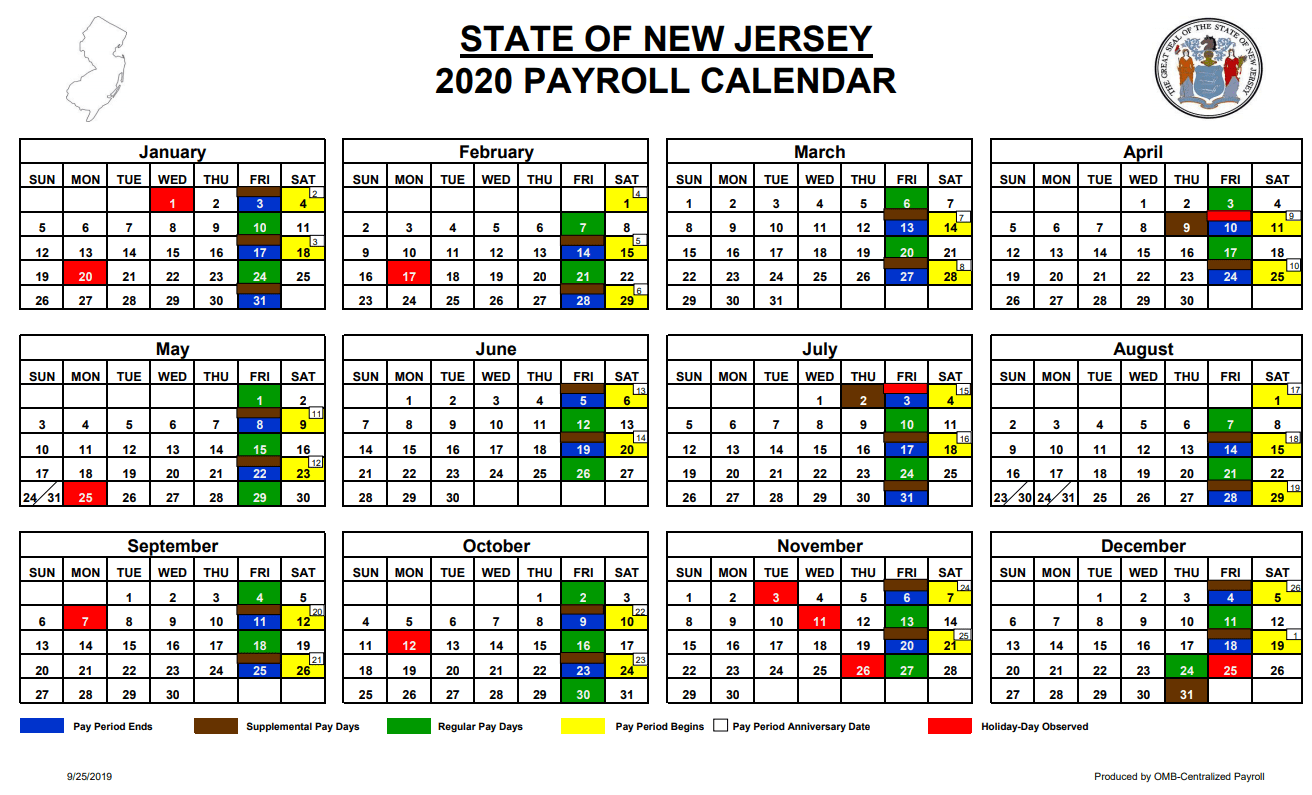

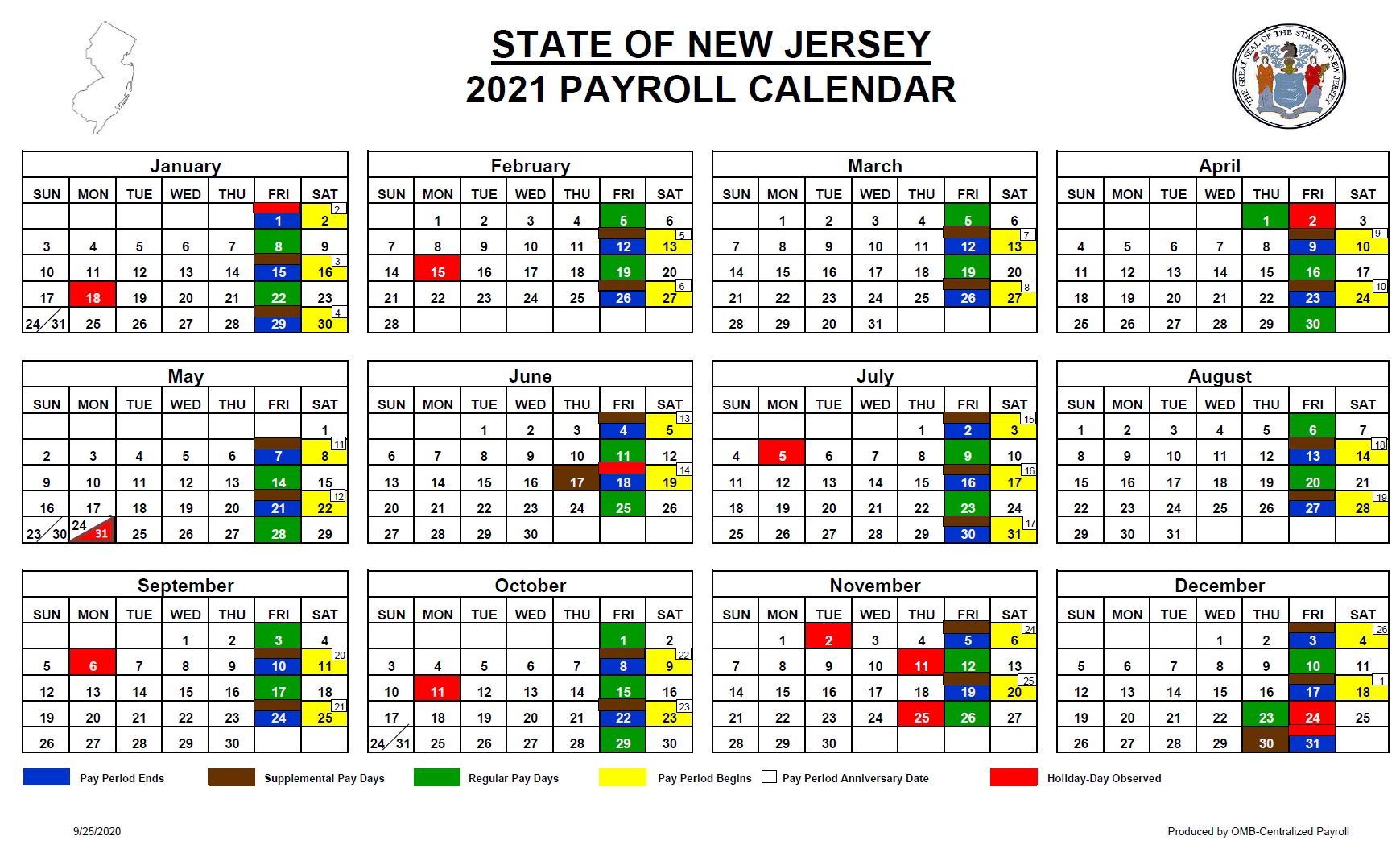

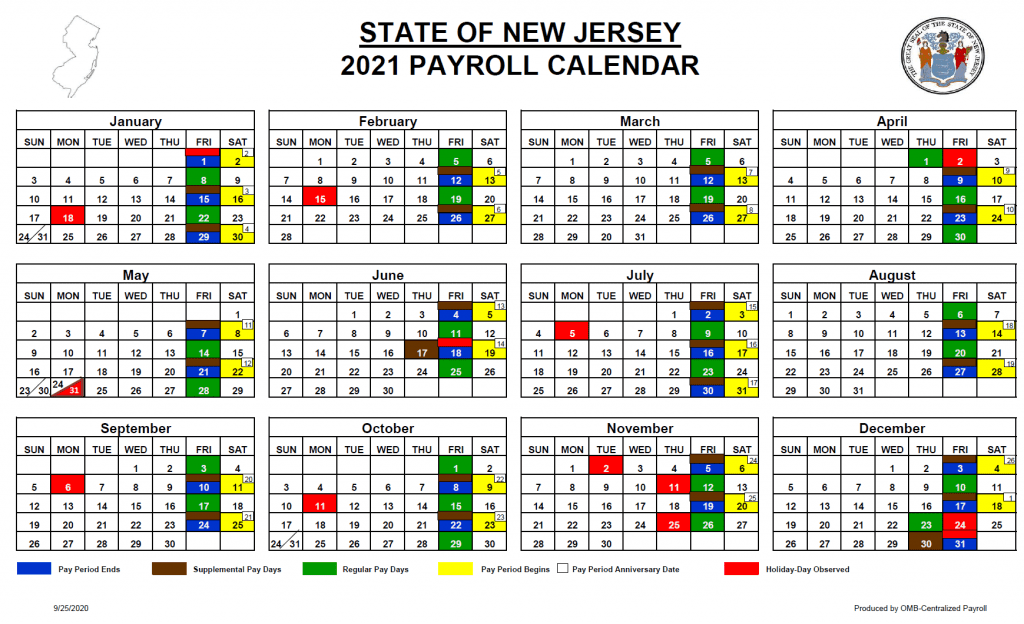

The New Jersey state payroll calendar for 2025, whereas not but formally launched, will be anticipated based mostly on historic tendencies and established state practices. This text supplies a complete overview of what to anticipate, providing insights into the doubtless cost schedule, key concerns for state workers, and assets for staying knowledgeable. Predicting the precise dates requires understanding the state’s payroll processing cycle and its adherence to holidays and legislative mandates.

Understanding the New Jersey State Payroll System:

The New Jersey state authorities employs an enormous workforce, necessitating a sturdy and environment friendly payroll system. This method is designed to make sure well timed and correct compensation for all state workers, encompassing varied businesses, departments, and establishments. The payroll calendar is essential for budgeting, monetary planning, and guaranteeing easy operations inside every division.

The state doubtless makes use of a bi-weekly or semi-monthly cost schedule, that means workers obtain their paychecks both each two weeks or twice a month on predetermined dates. This constant schedule permits for predictable money circulation and simplifies monetary administration for each the state and its workers. Nonetheless, the precise frequency and particular cost dates are topic to alter based mostly on legislative selections or operational changes.

Predicting the 2025 Payroll Calendar:

Whereas the official 2025 calendar stays unreleased, we are able to extrapolate a possible schedule based mostly on the 2024 calendar and previous tendencies. A number of elements affect the payroll dates:

-

Pay Durations: The state’s payroll division will doubtless preserve a constant pay interval construction, both bi-weekly or semi-monthly. This implies the variety of pay durations in 2025 will stay comparatively in keeping with earlier years.

-

Holidays: New Jersey observes a number of state and federal holidays. These holidays immediately influence the payroll schedule, usually leading to shifted pay dates to accommodate the non-working days. Key holidays to think about embrace New 12 months’s Day, Martin Luther King Jr. Day, Presidents’ Day, Memorial Day, Juneteenth, Independence Day, Labor Day, Columbus Day, Veterans Day, Thanksgiving, and Christmas. If a payday falls on a weekend or vacation, the cost will doubtless be superior to the previous Friday.

-

Legislative Classes: Whereas much less immediately impactful than holidays, important legislative classes or price range approvals can not directly have an effect on the payroll schedule by means of potential delays in funding or procedural modifications.

-

System Upgrades or Upkeep: Occasional system upgrades or upkeep inside the state’s payroll system may result in minor shifts in cost dates. These are normally introduced effectively prematurely to reduce disruption.

Key Issues for State Workers:

-

Direct Deposit: The overwhelming majority of New Jersey state workers obtain their paychecks through direct deposit. This methodology ensures well timed and safe cost, eliminating the necessity for bodily checks and lowering the chance of loss or theft. Workers ought to guarantee their banking info is up-to-date with the payroll division.

-

Pay Stubs: Digital pay stubs, accessible on-line by means of the state’s worker portal, present detailed details about every paycheck, together with gross pay, deductions, internet pay, and year-to-date totals. Workers ought to commonly assessment their pay stubs to establish any discrepancies or errors.

-

Tax Withholding: Workers are accountable for guaranteeing their tax withholding info is correct to keep away from underpayment or overpayment of taxes. Adjustments to marital standing, variety of dependents, or different related elements must be promptly reported to the payroll division.

-

Advantages Enrollment: New Jersey doubtless provides a complete advantages bundle to its state workers, together with medical insurance, retirement plans, and different welfare applications. Workers ought to perceive their eligibility and enrollment procedures, guaranteeing their advantages are precisely mirrored of their payroll deductions.

-

Contacting the Payroll Division: In case of any questions, discrepancies, or points associated to payroll, workers ought to promptly contact the related state payroll division. Contact info is normally accessible on the state’s worker portal or by means of inside communications.

Staying Knowledgeable concerning the 2025 Payroll Calendar:

The official 2025 New Jersey state payroll calendar shall be launched by the state’s Division of Personnel or an analogous company accountable for payroll administration. Workers ought to commonly examine the next assets for updates:

-

State Worker Portal: The official state worker portal will doubtless be the first supply for the discharge of the payroll calendar. This portal usually accommodates essential info for state workers, together with payroll schedules, advantages info, and different related updates.

-

Inner Communications: State businesses usually talk essential info, together with payroll schedules, by means of inside emails, memos, or newsletters. Workers ought to stay attentive to those communications.

-

State Authorities Web site: The official web site of the New Jersey state authorities might also publish the payroll calendar or present hyperlinks to related assets.

-

Union Representatives: If relevant, union representatives can usually present precious info and help relating to payroll issues.

Conclusion:

Whereas the exact 2025 New Jersey state payroll calendar stays unavailable at the moment, understanding the elements that affect its creation permits for knowledgeable anticipation. By commonly monitoring official state assets and sustaining open communication with the payroll division, state workers can successfully handle their funds and guarantee well timed receipt of their compensation. This complete information goals to offer a framework for understanding the doubtless schedule and navigating the intricacies of the New Jersey state payroll system. Keep in mind that this info is predicated on historic tendencies and predictions, and the official calendar ought to all the time be thought-about the definitive supply. Staying proactive and knowledgeable is essential for guaranteeing a easy and hassle-free payroll expertise all year long.

Closure

Thus, we hope this text has offered precious insights into Navigating the 2025 New Jersey State Payroll Calendar: A Complete Information. We respect your consideration to our article. See you in our subsequent article!