Decoding the West Virginia Public Workers Retirement System (PERS) Fee Calendar: A Complete Information

Associated Articles: Decoding the West Virginia Public Workers Retirement System (PERS) Fee Calendar: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Decoding the West Virginia Public Workers Retirement System (PERS) Fee Calendar: A Complete Information. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Decoding the West Virginia Public Workers Retirement System (PERS) Fee Calendar: A Complete Information

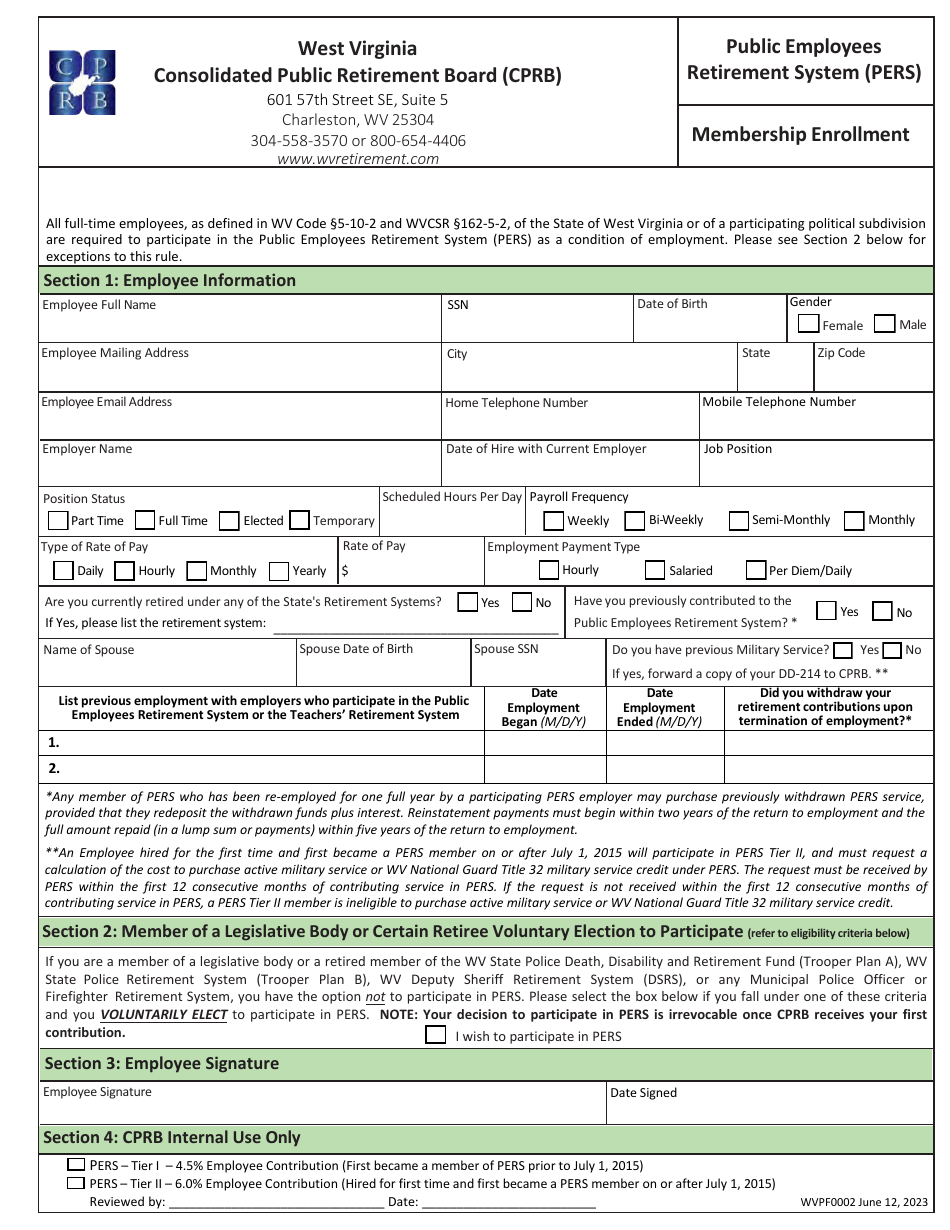

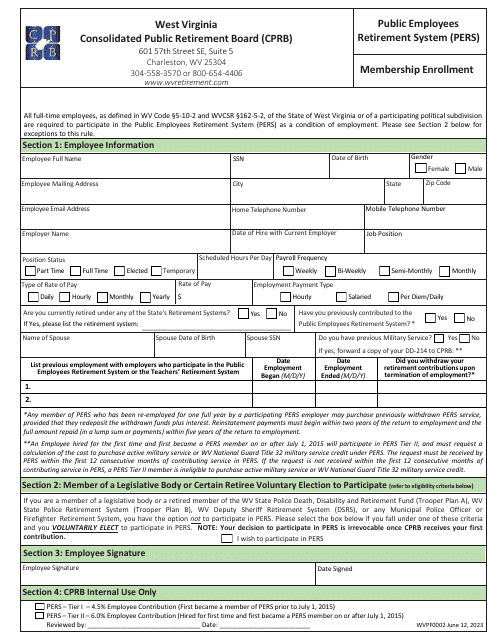

The West Virginia Public Workers Retirement System (PERS) offers essential retirement advantages to 1000’s of devoted public servants. Understanding the cost calendar and the components influencing it is important for retirees and people planning for retirement. This complete article will delve into the intricacies of the PERS cost calendar, addressing widespread questions and providing beneficial insights into the system’s mechanics.

Understanding the Fee Schedule: Month-to-month Consistency and Potential Variations

The core precept of the PERS cost calendar is month-to-month consistency. Retirees sometimes obtain their advantages on the identical day of every month, normally close to the start or center, relying on the precise cost methodology chosen. This predictable schedule permits for dependable finances planning and monetary stability. Nonetheless, slight variations can happen attributable to a number of components:

-

Financial institution Holidays: If the scheduled cost date falls on a weekend or a federal or state vacation, the cost is usually superior to the previous enterprise day. PERS proactively adjusts the cost schedule to make sure well timed supply. Staying knowledgeable about upcoming holidays is essential for correct expectation setting.

-

System Processing: Whereas uncommon, unexpected technical glitches or system upkeep may trigger minor delays. PERS maintains strong programs, however occasional hiccups can happen. In such situations, retirees are usually notified promptly by means of official channels.

-

Direct Deposit vs. Verify Mailing: The tactic of receiving funds can affect the arrival time. Direct deposit normally offers sooner entry to funds, typically crediting the account on the scheduled day or the day earlier than. Verify mailing, nevertheless, may take just a few extra days attributable to postal transit occasions.

Accessing Your Fee Data: On-line Sources and Buyer Assist

PERS offers numerous avenues for accessing your cost data and staying up to date on the cost calendar:

-

On-line Account Entry: The PERS web site affords a safe on-line portal for retirees to entry their account data, together with cost historical past, upcoming cost dates, and profit statements. This on-line portal offers probably the most dependable and up-to-date data. It is essential to register for on-line entry if you have not already.

-

Contacting PERS Instantly: PERS maintains a devoted customer support division to reply inquiries associated to funds and different retirement-related issues. Contacting them by way of telephone or e mail is one other dependable option to get particular data concerning your cost schedule. Their contact data is available on the official web site.

-

Profit Statements: Recurrently reviewing your profit statements is essential. These statements present an in depth breakdown of your month-to-month profit quantity, any changes made, and the cost schedule. Any discrepancies or surprising modifications ought to be promptly reported to PERS.

Elements Affecting Fee Quantities: A Detailed Breakdown

A number of components can affect the quantity of your month-to-month PERS cost:

-

Years of Service: The longer you served as a public worker in West Virginia, the upper your retirement profit will likely be, reflecting the collected contributions and years of devoted service.

-

Remaining Common Wage: Your remaining common wage, sometimes calculated as a mean of your highest-earning years, performs a big position in figuring out your month-to-month cost. The next remaining common wage interprets to a bigger retirement profit.

-

Retirement Plan Kind: West Virginia PERS affords totally different retirement plan choices, every with its personal calculation methodology. Understanding the specifics of your chosen plan is essential for correct profit estimation.

-

Value of Residing Changes (COLA): PERS might periodically modify funds to account for inflation. These price of dwelling changes (COLA) assist keep the buying energy of your retirement advantages. The frequency and share of COLA changes are topic to legislative approval and budgetary concerns.

-

Early Retirement Penalties: Retiring earlier than reaching the total retirement age might end in a decreased month-to-month profit. The precise penalty depends upon the variety of years earlier than reaching full retirement age.

-

Incapacity Advantages: For these retiring attributable to incapacity, the calculation of advantages differs from commonplace retirement calculations, making an allowance for the character and extent of the incapacity.

Planning for Retirement: Budgeting and Monetary Methods

Receiving your PERS cost is just one piece of the retirement puzzle. Efficient monetary planning is crucial to make sure a snug and safe retirement. Think about these methods:

-

Budgeting: Create an in depth finances outlining your month-to-month bills and earnings, together with your PERS cost. It will assist you perceive your monetary wants and be sure that your retirement earnings is ample.

-

Healthcare Prices: Consider healthcare bills, which might considerably impression your retirement finances. Discover Medicare choices and complement insurance coverage to handle these prices successfully.

-

Funding Methods: Think about supplementing your PERS funds with different earnings sources, resembling investments or part-time work. A diversified funding portfolio can present extra monetary safety.

-

Lengthy-Time period Care Planning: Plan for potential long-term care wants, as these can incur important bills. Discover long-term care insurance coverage choices or different monetary methods to mitigate these dangers.

-

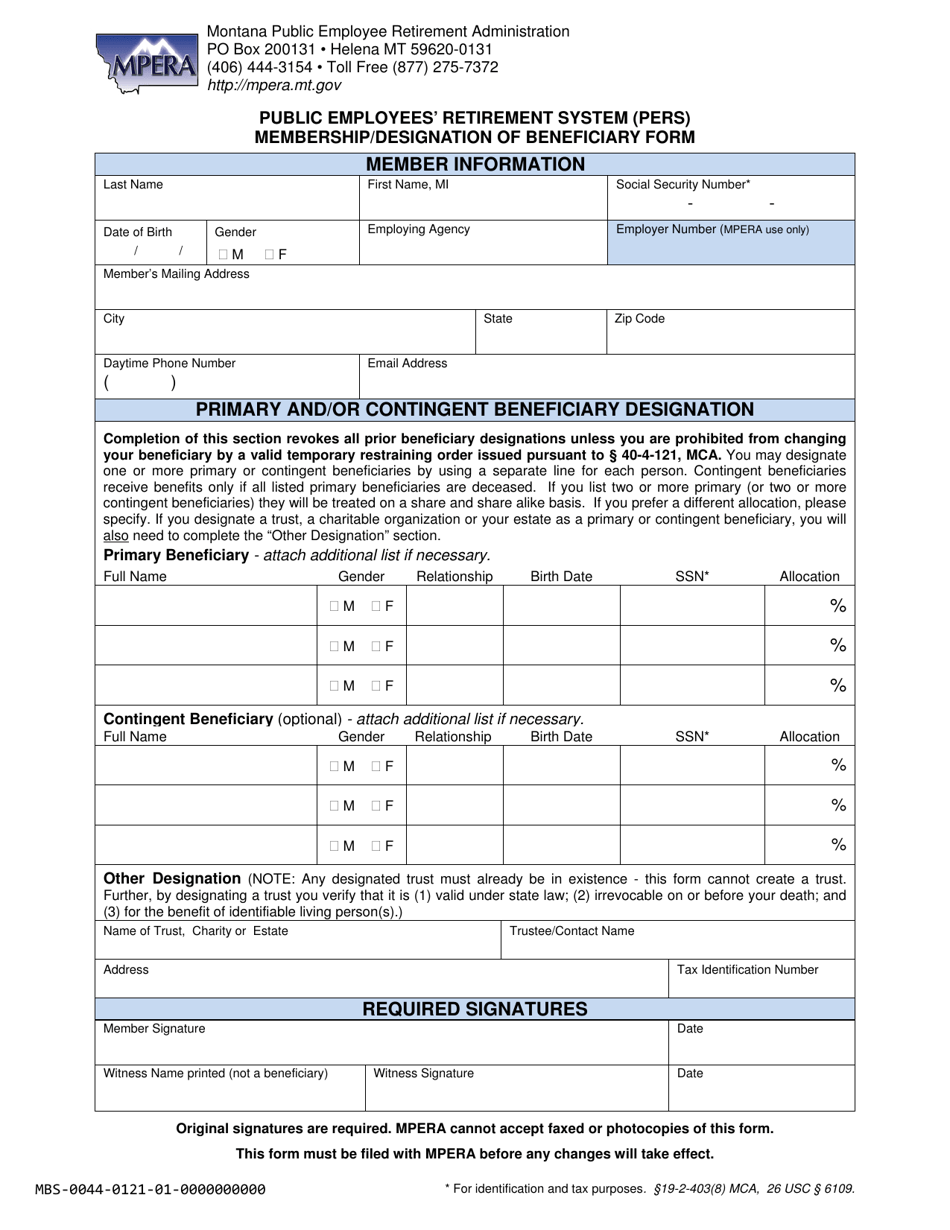

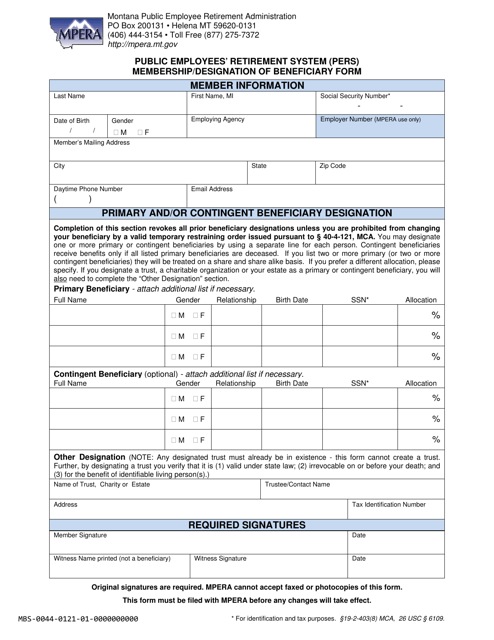

Property Planning: Develop an property plan to handle your property and guarantee a easy transition to your beneficiaries after your passing.

Conclusion: Staying Knowledgeable and Proactive

The West Virginia Public Workers Retirement System offers a significant security web for public servants. Understanding the intricacies of the PERS cost calendar, accessing obtainable assets, and proactively planning for retirement are essential steps towards making certain a safe and cozy retirement. By staying knowledgeable, using the web assets supplied by PERS, and in search of skilled monetary recommendation when essential, retirees can successfully handle their funds and revel in a well-deserved retirement. Bear in mind to usually overview your profit statements and call PERS straight with any questions or considerations concerning your funds or different retirement-related issues. Proactive engagement ensures a smoother and extra knowledgeable retirement journey.

Closure

Thus, we hope this text has supplied beneficial insights into Decoding the West Virginia Public Workers Retirement System (PERS) Fee Calendar: A Complete Information. We recognize your consideration to our article. See you in our subsequent article!